The CAS Research Paper Series on Race and Insurance Pricing Delivers Greater Insight into Potential Bias in Insurance Practices

Detecting and addressing potential bias in ratemaking and other insurance practices will continue to be a pressing concern in the future — regardless of the political climate.

The reasons are manifold: The regulatory appetite to consider potential bias in rating, the evolution of artificial intelligence (AI)-based modeling and the continuing explosion of data sources amid demographic and economic changes are also impacting the insurance industry.

To err with bias is human — and often happens without realization. People perceive their world through filters, including life experience, socioeconomic background and education. Unintentionally using economic conditions as a proxy for an ethnic group, for instance, is a form of bias.

Our understanding of bias is also evolving. In the 1940s, states adopted rules that precluded insurers from collecting racial data. Bias can be very subtle — data can lack context, and bias can be embedded in model design. AI can introduce bias without people realizing it.

“Actuaries have the expertise to play a significant role in identifying and addressing potential bias,” said Mallika Bender, CAS staff actuary and manager of the organization’s Race and Insurance Pricing Series.

Phase II of the CAS Research Paper Series on Race and Insurance Pricing builds on actuarial knowledge concerning potential bias in insurance practice that began in 2020. Released from August 2024 to March 2025, its six research papers explore several angles of mitigating potential bias in insurance, including the evolving regulatory landscape, how to detect bias in the ratemaking process and the potential unintended consequences of adjusting rating factors.

“Actuaries are being challenged to navigate a complex set of regulations, and the papers are a useful set of tools for navigating that effectively,” said Jim Weiss, former CAS vice president of research and development when Phase II of the series began. Weiss, AR editor in chief, also published an independent paper on managing potential bias in insurance models in E-Forum last year.

CAS Past President Roosevelt C. Mosley, who was instrumental in establishing Phase I of the series, observed, “The state of the regulatory environment regarding fairness is continually evolving.” He also warned, “Actuaries need to pay attention or risk getting too far behind.”

Evolving regulatory landscape

Three research reports explore the regulatory landscape. “Regulatory Perspectives on Algorithmic Bias and Unfair Discrimination” and “A Practical Guide to Navigating Fairness in Insurance” discuss the National Association of Insurance Commissioners’ (NAIC) initiatives and separate activities of individual U.S. states. “Comparison of Regulatory Framework for Non-Discriminatory AI Usage in Insurance,” released jointly with the Society of Actuaries, also provides a window into how regulators outside the U.S. are considering potential discrimination arising from AI use.

Three research reports explore the regulatory landscape. “Regulatory Perspectives on Algorithmic Bias and Unfair Discrimination” and “A Practical Guide to Navigating Fairness in Insurance” discuss the National Association of Insurance Commissioners’ (NAIC) initiatives and separate activities of individual U.S. states. “Comparison of Regulatory Framework for Non-Discriminatory AI Usage in Insurance,” released jointly with the Society of Actuaries, also provides a window into how regulators outside the U.S. are considering potential discrimination arising from AI use.

Understanding how regulators currently perceive potential bias in insurance is a crucial first step in determining how the industry may move forward in the future. The “Regulatory Perspectives” paper features responses from 10 of the 50 state insurance departments that responded in a CAS-sponsored survey in 2024.

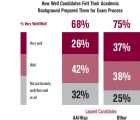

Actuaries might be surprised to learn that actuarial soundness — considered paramount in ratemaking — was perceived by many surveyed regulators as insufficient for showing that insurance pricing is not impacted by bias.

“The authors found that the majority of regulators surveyed did not agree that profitability metrics should be considered with respect to algorithmic bias,” said Weiss. But “the majority did feel statistical fairness tests and variable explanations should be.”

Meanwhile, despite many regulators’ concerns about algorithmic bias, few were actively addressing the issue in their respective states. “There was consensus by a majority of the regulators that the issue would be more effectively addressed on a national rather than a state-by-state level [through the NAIC],” Weiss said.

Regulators generally agreed that insurers should use multiple bias-testing methods but had mixed views about applying them to populations by race or ethnicity. Some respondents raised concerns about the potential accuracy of approaches used to infer race or ethnicity such as the Bayesian Improved First Name Surname and Geocoding (BIFSG).

The “Regulatory Framework” research paper compares the views of regulators from the U.S., Canada, Asia and the European Union regarding the potential impact of AI and its potential for introducing bias. “Regulators across the world have not figured out how to regulate AI in general, let alone in the insurance industry,” said Ken Williams, CAS chief of advocacy and staff actuary.

“Regulators are concerned about whether or not the bias in AI will hurt the consumers,” Williams said. He cited Table 2 (page 10), where EU regulators identify AI activities by degrees of risk to protected classes, such as consumers in low-income brackets. Notably, ratemaking and pricing bias are considered high risk for protected classes.

Detecting and adjusting potential bias

“Regulators are not mandating the need to understand what could be causing bias,” Weiss said, whether it arises from input, training or programming. “Navigating Fairness” explains how to guard against and mitigate bias in all types of insurance models. This research paper can help actuaries more thoroughly explore the sources of bias, Weiss said. Williams added that the research paper can also benefit actuaries working for small- to medium-sized insurance companies, while laypeople can also gain insights into potential bias at a practical level.

From the viewpoints of the model-builder, manager and those responsible for monitoring risk across all of insurer models, “Navigating Fairness” allows for a comprehensive framework for ensuring model fairness.

Like “Regulatory Perspectives,” this research paper catalogs numerous regulations and legislation related to unfair discrimination. Actuaries will appreciate the report’s structured guidance in Table 2 (page 13), Williams said, because it covers model governance and fairness considerations through a series of linear steps — from gathering data to model implementation. The research paper also features a list of data categories considered higher risk, such as medical cost, social media and internet usage data.

Another research paper, “Practical Application of Bias Measurement and Mitigation Techniques,” published as Part 1 and Part 2, is a handbook that guides actuaries through the process of testing models for fairness. Using hypothetical insurance pricing examples, the paper steps through methodologies that actuaries can apply to their own pricing data.

Another research paper, “Practical Application of Bias Measurement and Mitigation Techniques,” published as Part 1 and Part 2, is a handbook that guides actuaries through the process of testing models for fairness. Using hypothetical insurance pricing examples, the paper steps through methodologies that actuaries can apply to their own pricing data.

“Part 1 — Types of Bias, Imputing Protected Class, and Simple Fairness Tests” illustrates how to apply the BISG method to infer race and ethnicity and includes essential caveats and data cleansing steps. Building upon three fairness tests mentioned in the Phase I research paper, “Methods for Quantifying Discriminatory Effects on Protected Classes in Insurance,” the paper shows how independence, separation and sufficiency can be applied to premium and loss ratio data. The research also explains the benefits and limitations of these metrics.

“Part 2 — Advanced Fairness Tests, Bias Mitigation, and Non-Modeling Considerations” illustrates additional approaches that may better address nuances in insurance data, such as variations in the distribution of protected groups across different rating factors. The report also outlines several technical approaches that can be applied before, during or after the modeling process if fairness concerns arise.

Variable views

When considering the potential of specific variables to carry bias, regulators expressed varying concerns in the “Regulatory Perspectives” research paper. Regulators shared concern that rating factors such as homeownership and occupation, as examples, could carry bias.

To Williams’ surprise, however, “regulators showed less concern for the motor vehicle driving record as a rating variable when some research suggests that protected groups may be more likely to be pulled over by police for driving infractions.” These issues were explored in the Phase I paper, “Understanding Potential Influences of Racial Bias on P&C Insurance: Four Rating Factors Explored.”

Since telematics data directly gauges driver behavior, it has the potential to reduce reliance on traditional rating factors. “Balancing Risk Assessment and Social Fairness: An Auto Telematics Case Study” considers which traditional rating factors that telematics might replace. By comparing the impact of telematics on both synthetic data and an individual Canadian insurance company’s data, the research reveals the impact of telematics on certain rating variables while stressing that results will vary by insurance company, Williams said.

Since telematics data directly gauges driver behavior, it has the potential to reduce reliance on traditional rating factors. “Balancing Risk Assessment and Social Fairness: An Auto Telematics Case Study” considers which traditional rating factors that telematics might replace. By comparing the impact of telematics on both synthetic data and an individual Canadian insurance company’s data, the research reveals the impact of telematics on certain rating variables while stressing that results will vary by insurance company, Williams said.

“If you accept the findings with the synthetic data,” Weiss offered, “you have a pathway on how you can take out some of the proxies and replace them with first order relationship to loss that feel more causal and start to fit with regulation.” He added that the general “thought process is helpful for actuaries as well.”

Consider the use of geography and territories for ratemaking. According to the “Telematics” report, territory was not a significant factor when applying telematics data to synthetic data. However, insurer data could not validate this conclusion. Meanwhile, surveyed regulators have mixed opinions of territory as a rating factor, according to the “Regulatory Perspectives” report.

Age, a time-honored factor, did not raise concerns among the surveyed regulators. Perhaps they are on to something. In the telematics study, an insured’s age, often a companion variable with gender, became less significant when using telematics information with both synthetic and insurer data. The same was true for marital status, another potentially sensitive variable.

Williams pointed out that telematics data, however, is not bias-free and can have unexpected impacts. He noted telematics information collected in the late hours of the night could disproportionately impact low-income earners who work second and third shifts.

The research also reveals that credit scoring — a controversial rating variable since its introduction more than 25 years ago and a concern to most survey respondents in “Regulatory Perspectives”—maintains predictive value even when using telematics. “Few other rating variables measure the likelihood of a future claim as well as credit-based insurance scoring does,” Williams observed.

The finding that credit-based insurance scores remain significant when used with telematics, said Mosley, a co-author of the Phase I research paper “Methods for Quantifying Discriminatory Effects on Protected Classes in Insurance,” underscores the significance of using credit scoring. “All of the work that has been done on credit-based insurance scores has shown that they do not have the negative impacts people claimed they do,” he added.

Unintended consequences

Ratemaking is a delicate art that balances multiple factors and considerations to ensure available and affordable coverage for consumers while maintaining insurer solvency and profitability. Regulatory changes to ratemaking, even to reduce potential bias against a class of customers, can result in unintended consequences.

The research paper, “Potential Unintended Impacts of Bias Mitigation in a Competitive Insurance Market,” demonstrates the effect that regulation can have on individual insurance carriers and the broader insurance market. By examining and providing realistic yet theoretical outcomes under various regulatory scenarios, it reveals potential outcomes that might surprise regulators.

The research paper, “Potential Unintended Impacts of Bias Mitigation in a Competitive Insurance Market,” demonstrates the effect that regulation can have on individual insurance carriers and the broader insurance market. By examining and providing realistic yet theoretical outcomes under various regulatory scenarios, it reveals potential outcomes that might surprise regulators.

Understanding the ramifications of future regulation to reduce bias is critical, Mosley warned. “We are headed down paths that are completely new territory for most of us, and if we don’t spend time thinking what could go wrong, it could create an impact on the market that is difficult to manage,” he said. Regulators could introduce a requirement, he explained, that ultimately could grant one insurer “a real serious advantage or disadvantage because [they happen to insure] a different demographic mix of policyholders.”

For instance, if a regulation limits rate differentiation by territory, insurers that serve primarily high-risk geographic areas might not be able to compete with carriers holding a more balanced book and a larger segment of policyholders, explained Bender. As a result, residents in riskier territories could face higher insurance costs or have fewer insurer options.

Although the topic is complex, the report is straightforward, Bender said. It includes numerous data tables illustrating examples of several potential unintended consequences.

Conclusion

As regulators and the insurance industry consider addressing potential bias in ratemaking and other insurance practices, experts advise actuaries to be familiar with the issues and potential impact on ratemaking and other insurance practices.

By providing a practical “suite of tools” actuaries can apply and adapt to their own work, Bender said, Phase II of the CAS Race and Insurance Pricing Series positions actuaries to add value and collaborate with the insurance industry.

Morgan Bugbee, CAS vice president of research and practice advancement, applauds “the rigorous and thoughtful analysis” in the Phase II research reports. “They address critical questions surrounding race and insurance pricing, offering data-driven insights that can help our profession better understand and serve diverse communities,” he explained. “We hope these findings spur ongoing dialogue and continuous improvement in actuarial practices and the broader insurance industry.”

A Brief History of the CAS Research Paper Series on Race and Insurance Pricing

The impetus for Phase I of the Race and Insurance Pricing series began in

2020. “Practically every industry had a renewed focus on identifying bias in

their sectors, especially with respect to race and ethnicity,” explained Mallika

Bender, CAS staff actuary and manager of the organization’s Race and

Insurance Pricing Series. “The National Association of Insurance Commissioners launched its Special Committee on Race and Insurance, and the CAS endeavored to make sure actuaries had the foundational knowledge to engage with regulators and address potential bias in their work.”

The four research reports in Phase I of the series, released in 2022, set the

foundation for the research papers. Phase II papers explore the opportunities

and limits of data and methodology, including AI.

In comparison to Phase I of the series, Phase II fleshes out the specifics of

how to mitigate bias, said Roosevelt C. Mosley, president of Pinnacle Actuarial

Resources. “These papers are very practical and written in ways actuaries can

approach and grasp,” he said. “It was a really good step, and I am really happy

to see that Phase II did that.”

To contribute to future phases of the CAS Research Paper Series on Race and Insurance Pricing, please contact Mallika Bender at mbender@casact.org.