“Insanity is doing the same thing over and over and expecting different results.”

—attributed to Albert Einstein

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness … it was the spring of hope, it was the winter of despair.” Charles Dickens may have been writing about French revolutionary times in his famed introduction to A Tale of Two Cities, but he could just as easily have been describing the U.S. commercial insurance sector over the past decade. Workers’ compensation has been on a remarkable nine-year run of sub-100 combined ratios,1 while commercial auto’s combined ratios have eclipsed 100 in 10 of the past 11 years.2

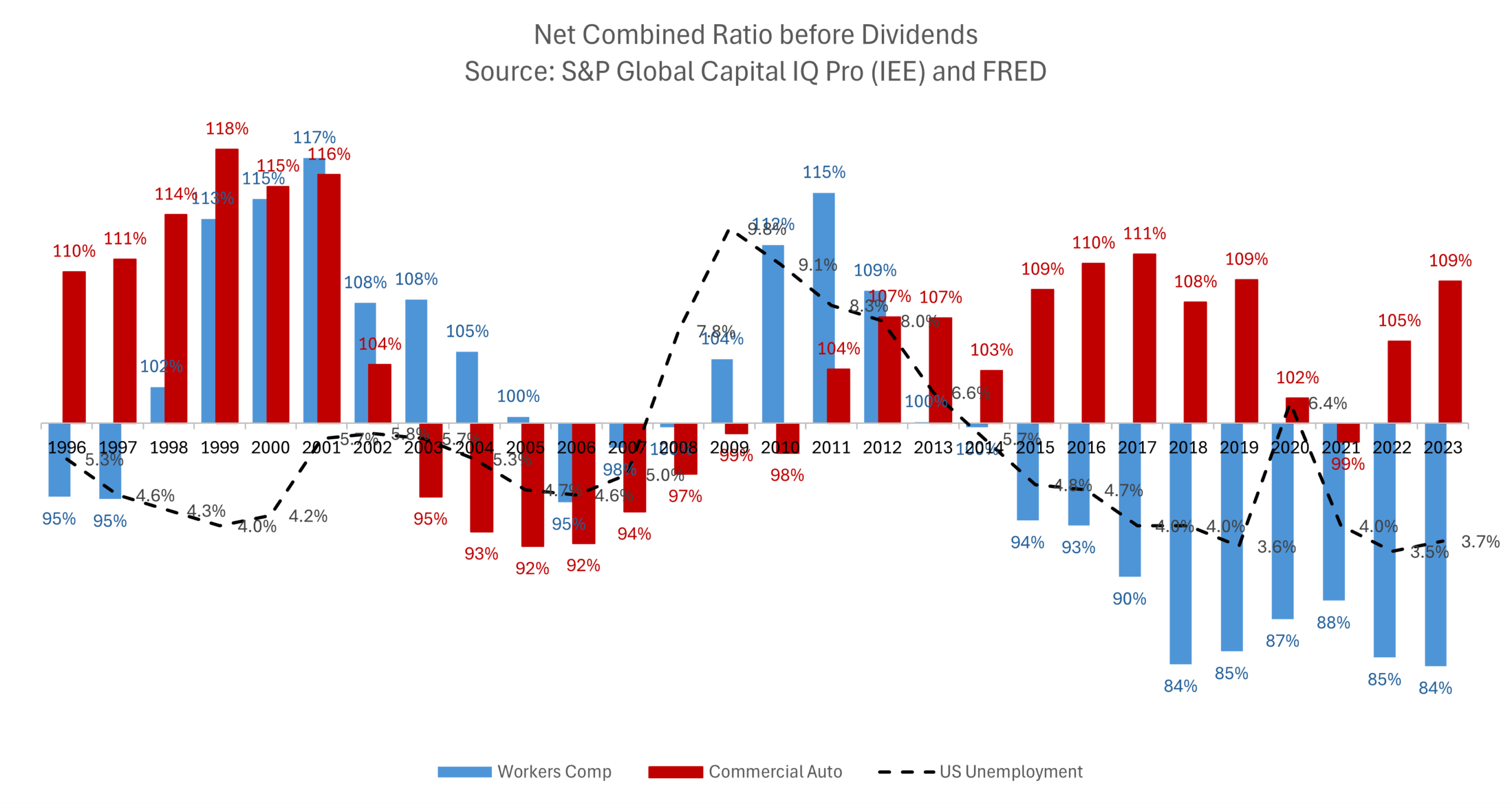

Many pundits expect these lines to continue their recent tendencies, with AM Best recently maintaining a stable outlook for workers’ compensation and a negative one for commercial auto.3 However, one need only look back to 2021 for the last time AM Best had a negative outlook for workers’ compensation4 and commercial auto yielded a sub-100 combined ratio. These were in (large) part pandemic-driven aberrations, but workers’ compensation also had a run of combined ratios over 100 between 2009 and 2012, while commercial auto yielded combined ratios in the 90s from 2003 to 2010. Figure 1 displays each line’s combined ratios since 1996.

In order to gain a sense of the longer-term future of these lines, we talked to several experts at rating agencies, consultants, advisory organizations and brokers. None claimed to have a crystal ball. “I’m more of a rear-view mirror guy,” joked Thomas Kenia, a senior managing director at Aon Reinsurance Solutions. Added Kevin Hughes, commercial auto actuarial director, Verisk, “The main problem actuaries face is a fundamental one: We are using data from the past to predict the future.” However, with the benefit of some hindsight, actuaries can gain greater insight into how rates have consistently lagged behind trends for these lines, how they can evolve their approaches going forward and whether there are any indications the two lines could trade places anytime soon.

“A-B study for a profitable insurance market”

“When you look at workers’ compensation, its underwriting profitability has really been the driver for the profitability we’ve seen in the entire commercial lines space,” says David Blades, associate director, AM Best Company. “Commercial auto has been the exact opposite for the longest time, despite some of the initiatives carriers have taken — concerning risk selection, price adequacy and trying to combat some of the factors affecting frequency and severity. It’s the loss leader.” Blake Berman, managing director, strategic advisory, Guy Carpenter summarizes commercial auto’s and workers’ compensation’s recent relative fortunes as follows: “The difference represents the litigation tax on the American economy. It’s an A-B study. If you take the plaintiff bar’s involvement out, many of the other elements of the claim costs are the same. If you take out the litigation and the extraordinary damages and all the court costs, you can have a profitable insurance market.”

Recent research from the CAS and the Insurance Information Institute supports this, attributing up to $30 billion— roughly 10 combined ratio points — in payouts over the past decade to “social inflation,” i.e., cost increases in excess of general inflation owing to factors such as litigiousness and third-party litigation funding.5 Meanwhile, the no-fault nature of workers’ compensation has generally insulated it from social inflationary pressures, although a recent article in Independent Agent magazine shared anecdotes that attorney involvement in workers’ compensation claims is ticking up.6

Besides benefiting from the less litigious nature of workers’ compensation, carriers have also played a hands-on role in the success of the line. “Companies have been able to employ their loss control experts to work with insureds, to help them take the necessary steps to improve their operations — cementing things that were done positively, reinforcing things that could be done better,” says Blades. “Over time we’ve seen different periods where medical inflation has exacted more of a negative effect, where it’s been going up. Keeping loss frequency under control has been able to mitigate some of the impact. The industry has done a really good job in workplace safety.” Limited studies into the efficacy of insurers’ loss control initiatives have shown reductions in the quarterly lost time claim frequency of roughly 2% per loss control visit occurrent during the preceding year.7

Blades has not observed the same loss control devotion from insurers in commercial auto compared to workers’ compensation. “I think it took companies a little while to fully buy into the fact that they need to put meaningful resources behind driver safety training and other initiatives to get the injection on capital where those initiatives could make a difference,” he says. Inexperienced drivers have compounded the pain. American Trucking Associations estimate a need for roughly 1,000,000 new drivers this decade, mostly due to retirements.8 Virginia Tech Transportation Institute research indicated less experienced commercial motor vehicle (CMV) drivers had crash rates several multiples higher than more experienced ones even after controlling for age.9 Kenia notes, “I think there is some reliance on vehicle technology to create benefits that exist directionally but are not a full replacement for the value of experience. Technology winds up being cheaper for businesses than experience, but drivers with more tenure have fewer accidents on the job. Statistics show that.”

“It may be time to let it go”

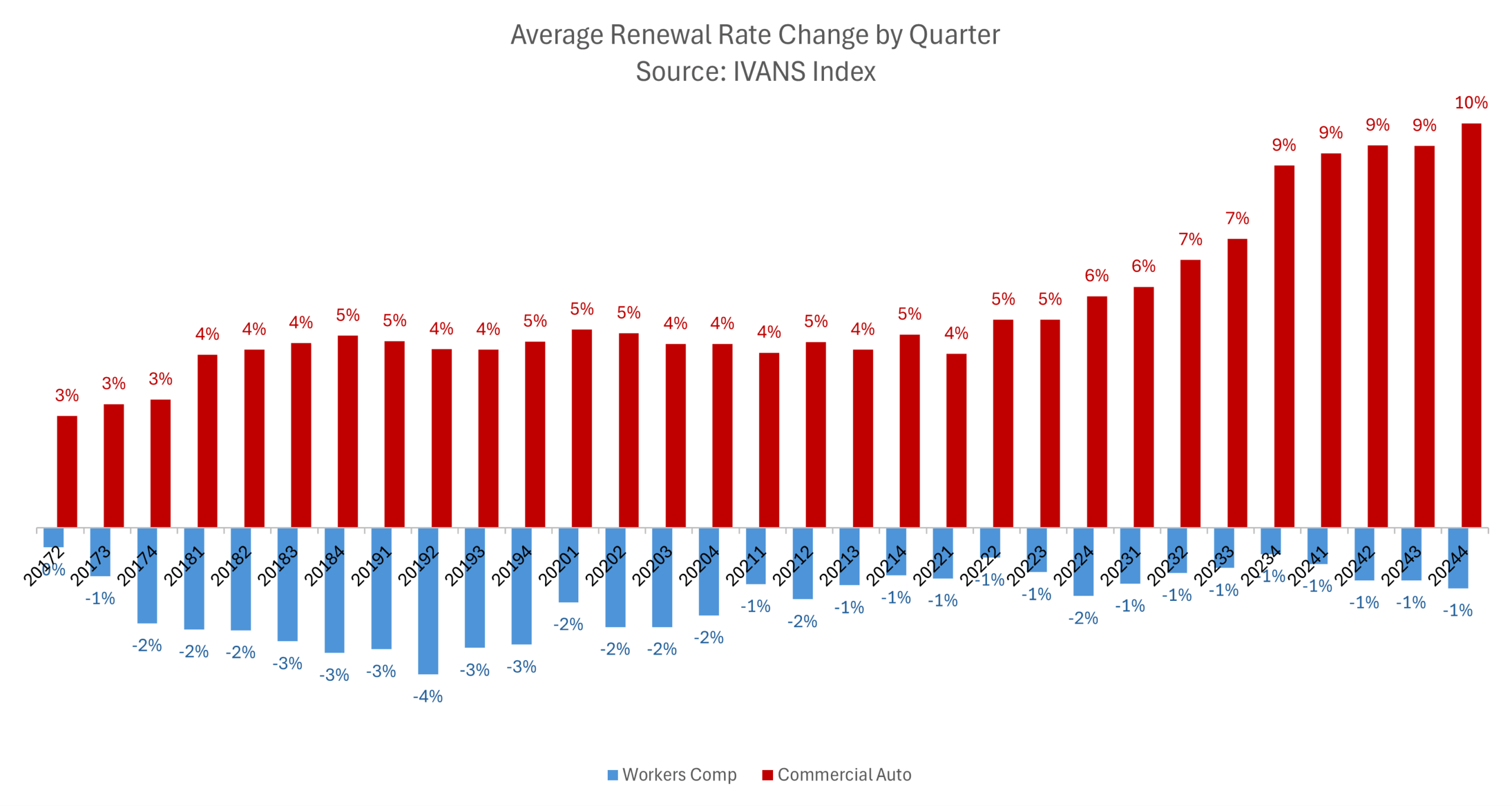

Carriers and their actuaries have been fully aware of premium redundancies and inadequacies in the line in question. The IVANS Index, which has tracked renewal rate changes across hundreds of insurers since 2017, shows commercial auto rates have increased and workers’ compensation rates have decreased every quarter since the inception of the index. Figure 2 displays the quarterly values of the index for each line. The commercial auto increases never rise above 10% and the workers’ compensation decreases never rise above 4% — so they have not made a huge impact on annual results.

Some of this may be by design. An AR article in 2019 spoke of carriers’ tendency to view commercial auto as a loss leader.10 Blades opines that commercial auto may still not always be the top priority for carriers on multiline opportunities. “[In some cases] carriers might take an account because the general liability or workers’ compensation or even the umbrella is really the prize for that account, and you might accept a pretty thin margin if any on the commercial auto,” he says. “I do think in some cases commercial auto has been more of an attendant line, not the driver.”

Social inflationary impacts on general liability and umbrella may temper carriers’ appetites to accept less on the auto, but insurers still may find themselves taking a haircut. “The challenge with auto is it’s highly competitive,” says Berman. “There are fairly low barriers to entry. Whenever you start to see green shoots, there is often a wave of managing general agents (MGAs) and new entrants coming in to take advantage of it.” Hughes adds, “If many insurers are underpricing, there are going to be great swaths of the line that you cannot compete for and may not want on your book at that rate. If some of that is already on your book, it may be time to let it go.”

Price sensitivity tends to be lower for workers’ compensation. “You’ve seen for many years an environment characterized by decreasing rate level,” observes Berman. “The claim experience for injured workers has improved as carriers have created a more cohesive network of providers and care plans to help people get healthy and back to work more quickly — and carriers are providing this at a reduced cost because of the better protections for workers.” The intricacies of carriers’ value proposition also create barriers to entry. “We have seen a relatively small number of newer companies come into the competitive environment, that might not have legacy issues, and that come in a little more aggressively,” says Blades. “However, workers’ compensation requires unique expertise in the underwriting, claims and loss control disciplines.”

Actuaries and their time-honored techniques have likely also played an implicit role in overshooting and undershooting workers’ compensation and commercial auto, respectively. “A challenge for actuaries is that they’re kind of stair stepping to update their assumptions,” says Berman. Techniques such as Bornhuetter-Ferguson premise loss estimates on a priori views of how a line will perform, which may be slow to evolve. “It is a little bit at a time, and it is very hard to keep up with an accelerating trend,” he adds. “Carriers are undoubtedly loading more [commercial auto] IBNR. Actuaries are using higher trend factors. But actuarial science has a hard time predicting behavior challenge.”

The pandemic exacerbated matters as carriers paused filing rate changes until some of the uncertainty resolved. “[For commercial auto] most carriers had not taken even a ‘customary’ increase the previous year, and that had to be made up, along with necessary increases from the severity side, as frequency returned to something like normal,” says Hughes. “Severity trend did cool from the red-hot numbers of 2022, but costs continued to rise — faster than what I would call normal — right up to the present day. Premiums had some catching up to do, and we had a (brief) moment at ISO where filing loss cost increases of 40% or higher became a matter of course.”

“Actuarial methods bear some attribution for deficiencies”

Insurers have learned from the remarkable decade in these lines. “One advantage in dealing with uncertainty, that actuaries didn’t have in 2022, is that we have just lived through the largest inflationary spike in loss severities in institutional memory,” says Hughes. “We have spent the last three years thinking long and hard about how best to react to this sort of thing. I think the industry is mentally better equipped to deal with future disruptions than it has ever been.”

There is also optimism that rate actions may begin to catch up with trends. “I think that some of the recent price momentum is going to manifest itself in additional earned premium and create some tailwinds that push commercial auto towards some improvement,” says Blades. For workers’ compensation, he adds, “a couple of things we keep looking at are reserve trends and prior-year reserve redundancy. Even though reserve margins are shrinking a little bit we’re still seeing redundancies. However, margins could shrink to a point where enough is enough — and we are seeing this mentioned in some outlooks.”

Commercial auto struggles and workers’ compensation triumphs have been relatively broadly distributed across carriers, with the majority writing the former taking underwriting losses and the majority writing the latter achieving gains. However, exceptions such as Progressive — a company that consistently outperforms in commercial auto — are potentially instructive. Blades describes such carriers as “really knowing what their sweet spot is from a risk appetite perspective.”

“A heavy investment in analytics seems to be the price of entry into the group of carriers who are consistently making money in commercial auto,” adds Hughes. “It should go without saying that the analytics have to be utilized with a focus on properly underwriting the auto risk on its own, not as a throw-in or an afterthought.” Such sharpened focus would not be entirely different from the industry’s commitment to workplace safety described previously in relationship to workers’ compensation.

History also suggests external forces affecting underwriting performance may be more predictable than actuaries give them credit for being. “You had a recession in the early 1990s that coincided with a period of market softening,” says Berman. “During this time auto was booked conservatively and proved to be redundant. Then the next time we had redundancies in auto was leading up to the 2008 crisis. You saw better than expected performance in those years and even 2020 has been holding up very well. So there definitely appears to a relationship between slowing economic activity and reduced commercial auto losses. Workers’ compensation can be the other way, where recession years see an influx of claims activity. 2020 could have been a lot worse without the Payroll Protection Program” (which helped preserve rateable payroll on policyholders’ books).

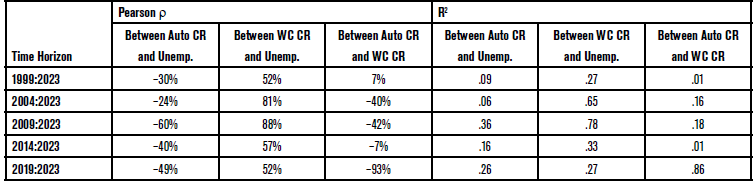

The sinusoidal patterns of each line’s combined ratio trajectories in many cases tracks well with econometrics such as the U.S. unemployment rate. Table 1 displays Pearson’s correlation coefficients and R-squared statistics for data from Figure 1.11 The former measures the strength of the linear relationship between two variables (values closer to positive or negative 100% indicate stronger relationships), while the latter measures the proportion of one variable’s variance that is statistically explained by the other (with 1.00 essentially being a perfect fit). Workers’ compensation performance correlates strongly with unemployment over various time horizons, while auto shows moderate to strong (negative) correlation — although R-squared statistics are on the lower side for both. “Is that enough for economic activity to be a governing variable in a pricing model?” asks Berman. “I wouldn’t necessarily propose that, but it is useful for informing comparisons between accident years.” Such has been a source of literary debate that flares up roughly once per decade.

Emilio Venezian’s 1985 paper on profit cycles, sometimes unkindly referred to as the “actuaries are dumb” theory, suggests that overly naïve extrapolations from past to future create the underwriting cycle — and the author even partitions lines of business into three categories based on the nature of their cyclicality. 12 Commercial auto and workers’ compensation ended up in different groups. Later work, including by CAS Past President Jessica Leong, synthesizes institutional frictions with other factors noted in this article such as market competition and economic cycles.13 Table 1 bears similarities to Table 3 of Forray and Ballweg’s 2013 paper on reserve cycles, which analyzes correlations between unemployment and adverse development. Those authors conclude, “actuarial methods bear some attribution for deficiencies that have been present within the carried reserves of the property and casualty insurance industry over time,” even though “actuaries were using standard and accepted — in fact, the most accepted – actuarial methods.”14

“An overshoot or … a new normal?”

If actuaries are to diverge from semimindlessly projecting these lines’ past into the future, and econometric data is too lagged or incongruent to factor in effectively, then identifying the next inflection point in the underwriting cycle will require fresh vision and ingenuity. While few of the experts we interviewed forecast large scale change for commercial auto or workers’ compensation in the near future, many offered indicators and Rubicons for if and when the lines’ fortunes may reverse.

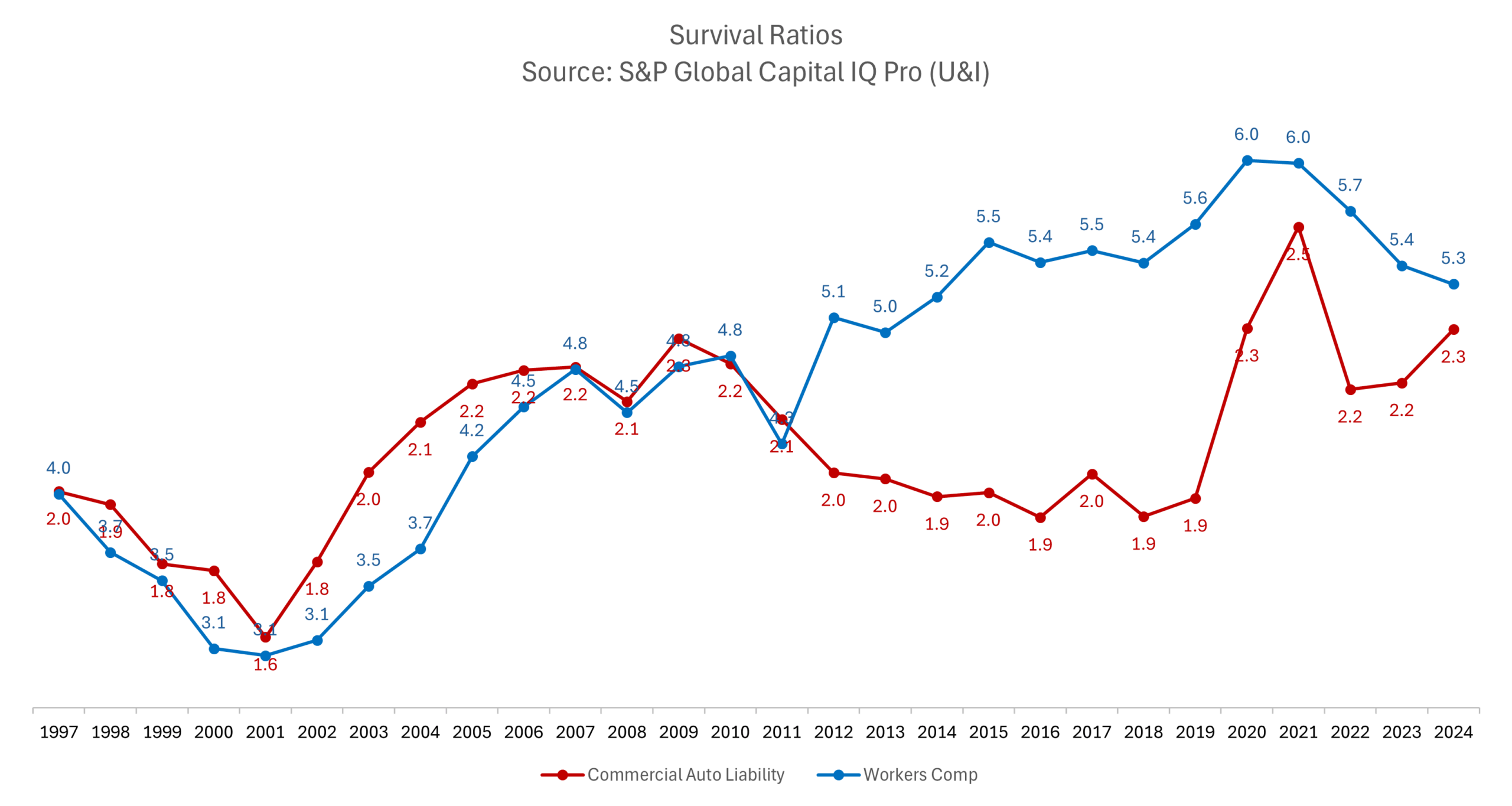

There do exist some indicators that suggest commercial auto could be approaching reserve adequacy if not redundancy. For example, Kenia points to survival ratios, which are calculated as reserves at the beginning of a calendar year divided by payments during the year, as one metric he tracks. Lower survival ratios generally indicate less adequate reserves, for example, during the lean years of the late 1990s and early 2000s. “I think an open question [for auto] is, are we going to see an overshoot, or are we going to see a new normal?,” he asks. “There is no downplaying of the underwriting result over the past 12 years. But the survival ratio has marginally improved to around what it was in say 2010 or 2011.” Figure 3 displays survival ratios by line. (Note that workers’ compensation yields higher ratios in general as a result of the lengthy nature of permanent disability claims.) Even several years removed from the pandemic, commercial auto’s ratios are approaching the levels they achieved during the 2000s period of profitability, while workers’ compensation’s ratios are inching towards levels last seen in the early 2010s, when the line was unprofitable.

Kenia cautions that these metrics don’t necessarily imply happier times ahead for commercial auto insurers. “It could be the case that [higher survival ratios] are a necessary but not sufficient condition for profitability. The development pattern has also been lengthening [which could also partially explain the increased survival ratios],” says Kenia. He also points to tort reforms in states such as Florida and Georgia as tailwinds that could potentially shorten development patterns and improve the overall health of the line.

As far as workers’ compensation goes, a strong economy evidentially and intuitively tends to go hand-in-hand with stronger workers’ compensation performance, and market volatility in the first quarter suggests that is not necessarily something to be taken for granted. However, the economy is not the only external force with potential to impact profitability.

Climate change is an emerging risk on many organizations’ risk registers, but they do not necessarily first think of the risk in connection with workers’ compensation. Garrett Bradford, GISP, principal and GIS consultant, and Sheryl Hou, consulting actuary, were two of the researchers on a recent study Milliman conducted on behalf of the Natural Resource Defense Council regarding impacts of excessive heat on workers’ compensation costs in North Carolina.15

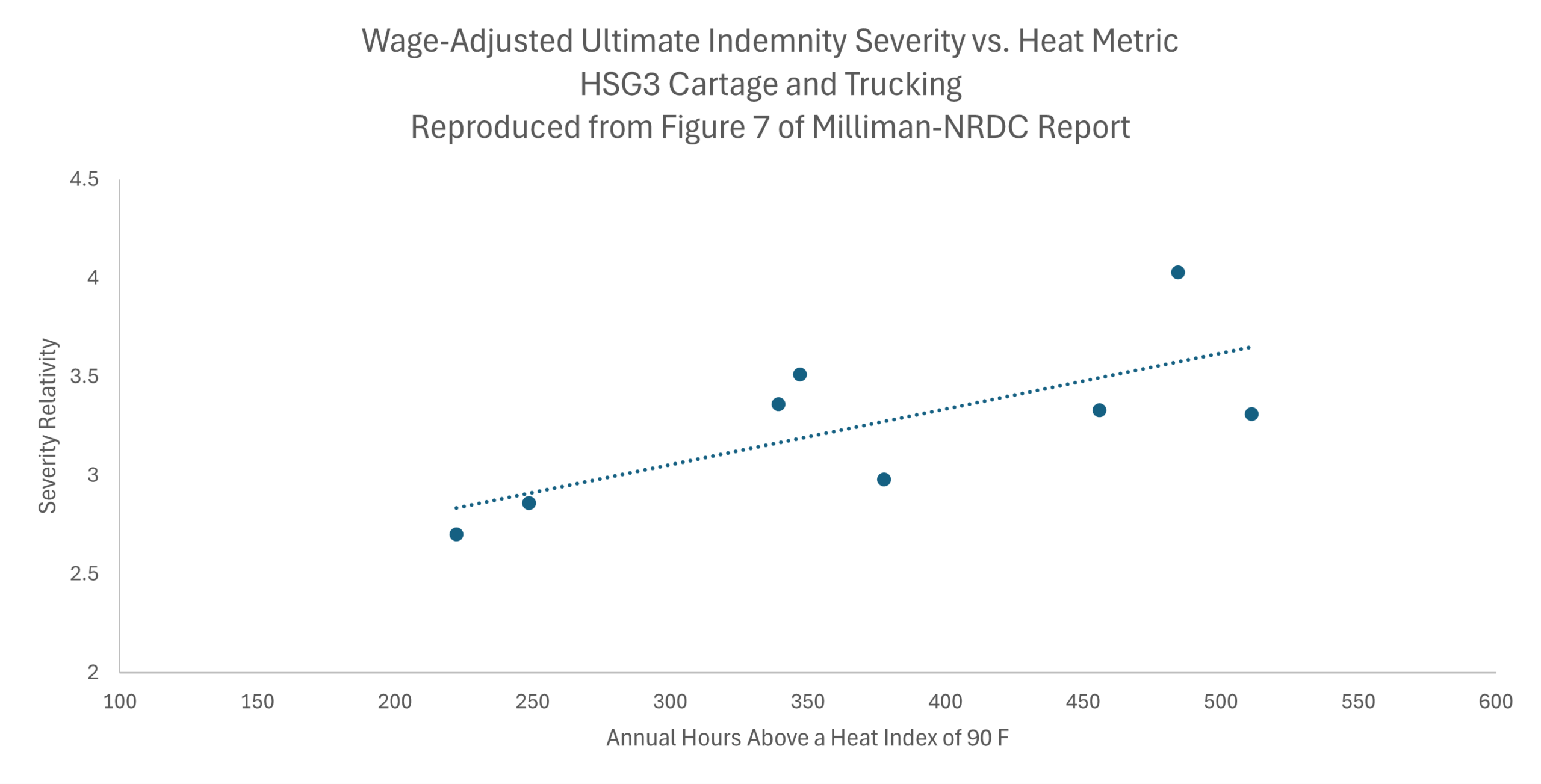

The Milliman researchers found statistically significant correlations between (wage-adjusted) indemnity costs and the annual hours above a heat index of 90°F / 32°C for several heat-exposed occupation groups. Their quantity of interest was the delta between each heat-exposed occupation group and a control group consisting of clerical and professional employees. Intriguingly, commercial auto intensive occupations such as Cartage and Trucking and Commercial Enterprises occupations exhibited roughly 70% correlations between the heat index and the indemnity severity, and these were statistically significant at the 15% level in their analysis. Figure 4 reproduces this analysis from the study. Bradford speculates, “While initially surprising, this relationship makes sense if you think about warehouse workers in this sector who might be subjected to heat-stress or to short-haul employees who are in and out of their vehicles. In some cases, I can think of delivery vehicles that don’t have AC or even doors.” Construction occupations also showed a roughly 50% correlation but with lower corresponding statistical significance.

We generally observe higher indemnity severities as the heat metric increases.

The study did not show as strong correlations between medical cost and heat indices as with indemnity. Bradford speculates this may be a reflection of claimant behavior. “Medical conditions that can be exacerbated by excessive heat may be lagged. If you go to the hospital a few days after an event because you’re still feeling sick, the incident may never be attributed to heat or having occurred in the workplace. While we didn’t have access to workers’ compensation claims data for this analysis, our analysis of healthcare utilization shows these lagged effects for at least three months.” Other heat impacts could also manifest as workers’ compensation claims. Says Hou: “With more extreme weather events like the ones we have seen recently, there may be more post-traumatic stress disorder (PTSD) claims from first responders.” As far as how carriers can take steps to protect themselves, Bradford also hearkens back to a key factor Blades raised to help explain workers’ compensation’s good fortunes: “You can always tweak your territory factors and get some sort of impact there, but the bigger opportunity may be to show employers what to do to protect employees’ health and safety during heat events.”

The end, or just the beginning?

Spoiler alert: The ending lines of A Tale of Two Cities come straight from its protagonist, Sydney Carton, as he is being led to the guillotine. “It is a far, far better thing that I do, than I have ever done; it is a far, far better rest that I go to than I have ever known.” For commercial auto and workers’ compensation, actuaries have largely been telling the same story for a decade — longer if we consider the economic cycle and the role of actuarial techniques in the underwriting cycle. That may well net out to be OK when each has an “identically opposite” commercial line at the ready to offset its outsized positive or negative results. However, as the world changes at breakneck speed, the organizations best equipped to get ahead of the cycle may be the ones who are willing to stick their neck out a little to gain a more precise view of what is coming next.

Jim Weiss, FCAS, CSPA, is divisional chief risk officer for commercial

and executive at Crum & Forster and is editor in chief for Actuarial Review.

- https://www.insurancejournal.com/magazines/mag-features/2024/07/15/783435.htm

- https://www.ncci.com/SecureDocuments/SOLGuide_2024.html

- https://www3.ambest.com/ambv/sales/bwpurchase.aspx?record_code=341644

- https://www3.ambest.com/ambv/sales/bwpurchase.aspx?altsrc=108&record_code=306916

- https://www.iii.org/press-release/social-inflation-contributed-to-30b-increase-in-commercial-auto-costs-paper-finds-030623

- https://www.iamagazine.com/markets/workers-comp-the-most-profitable-major-line-of-business

- https://pmc.ncbi.nlm.nih.gov/articles/PMC9301990/

- https://www.trucking.org/sites/default/files/2020-01/ATAs%20Driver%20Shortage%20Report%202019%20with%20cover.pdf

- https://vtechworks.lib.vt.edu/server/api/core/bitstreams/a5800006-4b00-4854-bd5c-1f3e76f5d5c1/content

- https://ar.casact.org/commercial-auto-woes-what-will-it-take-to-make-the-line-profitable/

- https://fred.stlouisfed.org/series/UNRATE

- https://www.jstor.org/stable/252782?seq=1

- https://www.casact.org/sites/default/files/2021-07/US-Property-Casualty-Wang-Major-Pan-Leong.pdf

- https://www.casact.org/sites/default/files/database/forum_13fforum_10-forray-ballweg.pdf

- https://edge.sitecorecloud.io/millimaninc5660-milliman6442-prod27d5-0001/media/Milliman/PDFs/2023-Articles/6-27-23_NRDC-Excessive-Heat-Report-NC.pdf