The views reflected in this article are the views of the authors and do not necessarily reflect the views of the global PwC organization or its member firms. The information contained in this publication is of a general nature only. It is not meant to be comprehensive and does not constitute the rendering of legal, tax or other professional advice or service by PwC.

For the international insurance market, the transition to International Financial Reporting Standard 17 (IFRS 17) from IFRS 4 is one of the most impactful events in the industry’s history. This change applies to insurance companies reporting under IFRS — 168 jurisdictions worldwide.

IFRS 17 strives to improve the transparency of insurers’ financial statements and makes insurance reporting more consistent across jurisdictions. The previous IFRS 4 rules could deviate significantly among neighboring markets (for example, in Europe/Asia).

However, IFRS 17 is still a principle-based standard and therefore has many areas that require management judgment. Actuaries are increasingly involved in the decision-making of these accounting policies and the ongoing setting of financial reporting assumptions.

In this article, we will focus on the pivotal role played by the P&C actuaries in the IFRS 17 transition. We will explore how this accounting standard change helps to untap the future capability of actuaries in the engine room for financial reporting and business planning.

First, we will get familiar with the IFRS 17 by understanding its impact on the P&C insurers’ top line and bottom line. Second, we will dive into the working language of IFRS 17 and how it helps to reshape the P&C business key performance indicators (KPIs) and enhance reporting intelligence. Third, we will explore opportunities for P&C actuaries to modernize financial reporting and planning based on IFRS 17 foundation and challenges to be mindful of.

Our viewpoint from the Asia market:

You may appreciate the difficulty to generalize trends for the “international insurance market.” Our study is based on our Asia market IFRS 17 work experience across Hong Kong, Shanghai, Singapore, Kuala Lumpur and Bangkok.

Our study is supplemented by an industry survey on over 60 P&C insurers in territories that have already gone live with IFRS 17, including Hong Kong, Singapore and Malaysia.

We are also preparing a research paper named “Actuarial Considerations Associated with IFRS 17 Implementation for General Insurers in Asia.” We look forward to presenting its Part 1 at the CAS Spring Meeting in Toronto.

What is the IFRS 17 impact to the P&C insurers’ top line and bottom line?

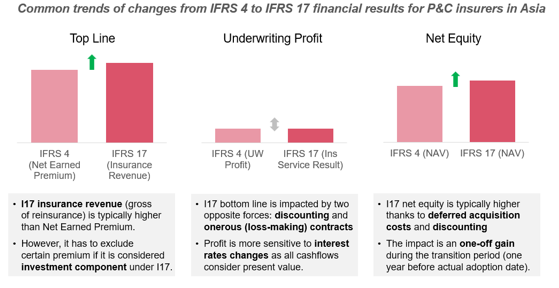

Based on our observations in the Asia market, the IFRS 17 adoptions produce generally positive impact to P&C insurers’ top line and net equity and often muted impact to the bottom line. The direction and magnitude of change would still vary by markets, as each local IFRS 4 sets a different starting point.

Here we will focus on the commonly observed trends as illustrated in Chart 1.

Top Line: The driver for the revenue increase is straightforward — IFRS 17 recognizes the insurance service revenue on the gross basis, and the ceded reinsurance premium is not deducted from the revenue. We will come back to the treatment of reinsurance in the next section. There are other factors that also impact the revenue, especially for reinsurers.

Bottom Line: The bottom line/underwriting profit doesn’t see significant impact compared to the life insurance counterpart. Life insurers tend to see acceleration or delay of profit recognition during their longer-term product cycle. One exception for the P&C side is when the interest rate fluctuates significantly, the bottom line would be impacted.

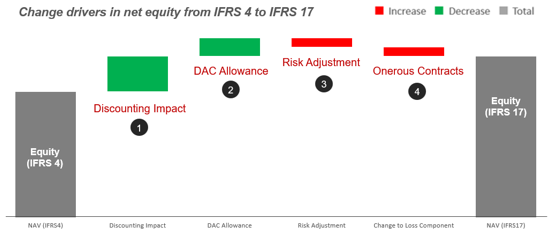

Net equity: The drivers for the net equity increase are most interesting — below we highlight the main factors for the P&C side (Chart 2):

Discounted cash flows: IFRS 17 applies discounting on claims and premium liability cash flows. Discounting under IFRS 4 is often optional, so the new change tends to reduce the reserve liabilities.

Deferred acquisition cost (DAC): IFRS 17 DAC includes costs directly related to business acquisition (similar to the U.S. Generally Accepted Accounting Principles, or GAAP). DAC under IFRS 4 is often limited or not required, so the new scope allows additional cost deferral and reduces the reserve liabilities.

Risk adjustment: IFRS 17 applies risk adjustment to reserves (unlike the U.S. GAAP). As many markets under IFRS 4 have already adopted risk adjustments, the impact is less material.

Onerous contracts: IFRS 17 advocates insurers to assess profitability of insurance portfolio at more granular level and prudently set aside deficiency reserve for those loss-making groups. This tends to strengthen the reserve liabilities.

We will provide a comprehensive tour of the full list of factors in our upcoming paper “Actuarial Considerations Associated with IFRS 17 Implementation for General Insurers in Asia.”

How does the new language of IFRS 17 help to enhance the P&C KPIs?

While the outcome changes in the previous section offer plenty of food for thought, it is just the tip of the iceberg. In this section, we will dive into the mechanics of IFRS 17 financial reporting, introduce the “unit of account” concept and explain why P&C actuaries are becoming more embedded in the reporting roles.

Unit of Account for P&C

The measuring units in the language of business, finance and actuarial functions used to be different, probably best demonstrated by the definition of a “year”: policy year versus financial year versus accident year. As the year’s definition embodies different exposure and liabilities, it is inherently difficult to align the measurement on the business performance.

IFRS 17 helps to address this challenge by adopting a unit that could be shared among functions. IFRS 17 requires insurers to organize insurance contracts into groups according to three criteria:

- Product portfolio subject to the same risk type and managed together.

- Degree of profitability.

- Year of issue.

Each group is assessed for its liabilities related to incurred claims (claims liabilities) and remaining coverage (premium liabilities). Actuaries thus need to produce reserve estimation at the more granular level.

To meet this grouping requirement, we found P&C insurers in practice have commonly adopted the following approach:

Product portfolios largely follow the existing product line structure, split into direct/assumed/ceded (if assumed is immaterial, combined direct and assumed). This helps the local industry to set a comparable framework.

Within a major product line, several product subgroups are divided if they operate differently and vary in profitability (such as online versus traditional, social welfare versus supplementary). This is where individual insurers customize their grouping. An agriculture insurer and a personal line insurer may have different groupings.

All groups of contracts are divided by year of issue. This last step represents a critical step up in granularity as it pushes P&C financial and actuarial reporting to integrate with the business viewpoint in policy year.

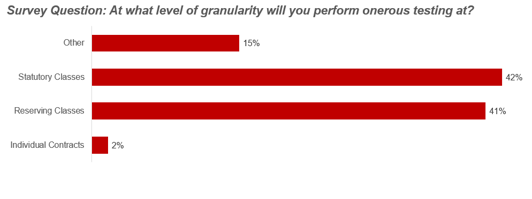

Our Asia survey (Chart 3) found the following trends:

42% of respondents perform profitability testing at the local statutory class level, while 41% of respondents perform it at the reserving class level. The local statutory class typically represents the minimum breakdown of product lines, while the insurer’s own reserving class represents the company’s own management approach.

We found larger insurers and specialty insurers have a tendency to seek more granular groupings, which represent the 15% cohort.

Some P&C reinsurers choose to model cashflows at the individual treaty level, which represent the remaining 2% (it is also common for direct insurers to treat outward reinsurance at individual treaty level, if not bundling similar treaties into one group).

The “five fingers” responsible for the P&L

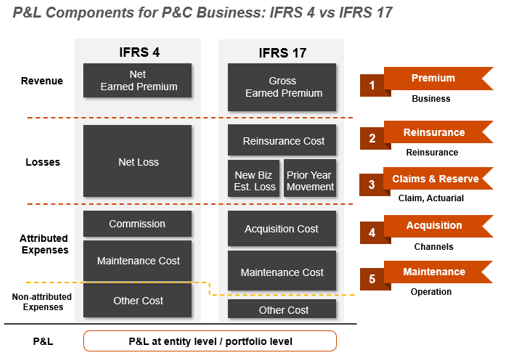

Based on the granular unit structure above, we are able to reconstruct the P&C business profit and loss statement (P&L). The changes could be captured on the high level in the comparison Chart 4.

Under IFRS 17, the P&C insurance P&L consists of five key components, as illustrated in Chart 4. We compare them to “five fingers” of the hand that controls and monitors the P&L. Specifically:

Gross Earned Premium: Revenue measure uses gross-basis premium (including direct & assumed) instead of net, which is comparable to the “gross income” concept common in other industries. Gross earned premium is closely associated with growth KPI.

Net Reinsurance Cost: Ceded reinsurance revenue, reinsurance commission and loss recovery are put in the same bucket to assess the net cost (or gain) of an outward reinsurance contract. In essence the insurer is paying for a financial service for risk mitigation/surplus relief purpose.

Claims and Reserves (old vs. new): Estimated claims development for new business (current policy year) are separated from the reserve movement for old business (prior policy years). This setup brings an actuarial reserving viewpoint into financial reporting, highlighting the tie between reserve movement from older accident years and current year P&L. However, this also brings closer scrutiny to historical reserve accuracy.

Acquisition Cost: As discussed in the previous section, this item captures the costs directly related to business acquisition, allowing DAC along with the direct insurance revenue earning.

Maintenance Cost: This item captures all the costs related to insurance service other than business acquisition. More importantly, maintenance cost also needs to be attributed to individual groups of contracts, just like acquisition cost. This requires a more robust process to allocate all the mid/back-office expenses to the front line (except for the costs not attributed to insurance services). This approach is comparable to “zero-based costing” in other industries.

In summary, the “five fingers” represent not only five distinctive P&L components, but also five interconnected functions/departments responsible for running the P&C business. Each finger tends to act in silo, but under IFRS 17 the five of them have potential to act in unison, as one hand.

When the financial result deviates from the budget, we could effectively identify “which finger to point” (no pun intended) and which team should be responsible for leading the problem solving (claims deterioration, unexpected reserve release, reinsurance cost pressure, service cost inflation, etc.).

During this IFRS 17 transformation, more measurement and modeling components are introduced to financial reporting. As a result, actuaries are becoming better positioned to analyze the financial report and cross-examine the change drivers.

What are the opportunities and challenges for P&C actuaries to modernize financial reporting and business planning under IFRS 17?

There is still work to do post-IFRS 17. With the improved data foundation and shared terminology under IFRS 17, we see P&C actuaries play a bigger role in modernizing insurance financial reporting and business planning.

Smarter data and analytics

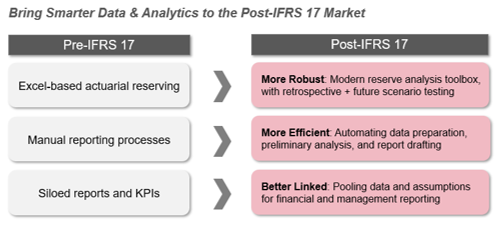

In Asia, many smaller insurers used to rely on manual or semi-manual reporting processes, and different departments often act in silo to produce regulatory and management reports. The IFRS 17 implementation journey has ushered in a major leap to the insurer’s state of data, systems and processes.

Post IFRS 17, smarter data and analytics would be essential to empower the more sophisticated reporting and planning. We believe P&C actuaries could actively contribute to such capability building in three ways (Chart 5):

More Robust: Modern reserve analysis toolbox, equipped with supporting functions such as retrospective testing and future scenario testing.

More Efficient: Automating data preparation, preliminary actuarial analysis and report drafting to free up the team’s time to carry out deep-dive investigation.

Better Linked: Pooling data and assumptions to provide a consistent basis for various financial and management reporting.

Deeper interconnectivity within reporting modules

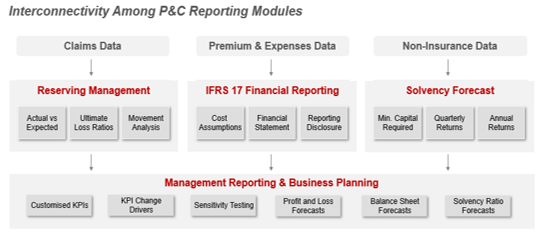

When exploring how to effectively take on the task of improving future reporting, we also took a step back and looked at the work required holistically. We have identified a stronger connection among reserving, P&L, solvency, management reporting and business planning post IFRS 17.

The chart below illustrates the flows of data, assumption and outcomes among these modules (Chart 6).

There is no coincidence that actuaries are playing a role in all of the four modules (in non-IFRS 17 markets, the dynamic still holds). Actuaries in reporting roles should always keep an eye on opportunities to improve the interconnectivity and consistency among these modules to make a more meaningful difference.

Challenges ahead

While there are exciting growth opportunities for P&C actuaries in the post-IFRS 17 markets, we should also pay close attention to the challenges ahead, both on the technical and managerial level:

P&C actuaries need to produce reserve estimation at the more granular level, such as for allocating reserve of a product portfolio into policy years.

Actuaries face closer scrutiny on reserving accuracy, since the IFRS 17 financial report now discloses movement of historical reserve.

Actuaries interested in IFRS 17 modernization work need to become proficient with insurance accounting concepts and financial reporting workflows.

Actuaries need to become proficient with the system design and data workflow of key modules including policy admin, expense management, reinsurance, accounting and payment, subledger and general ledger, etc.

Actuaries need to continue improving our communication skill set, enabling us to collaborate design with the finance team and to translate complex financial/actuarial /data concepts for senior management.