Catastrophes and inflation are combining to force property insurers and reinsurers to increase prices in record amounts to offset higher expected losses. In 2023, the U.S. experienced 28 catastrophic events, with each causing more than one billion dollars of damage. This followed a period during which replacement costs for home repairs increased significantly more than economic inflation.

The first general session of the 2024 CAS Spring Meeting focused on the state of the property market. Pat Abbe, U.S. regional and mutual strategic growth leader at Aon, provided the reinsurance perspective. Howard Kunst, chief actuary at CoreLogic, followed with an overview of the primary insurance market.

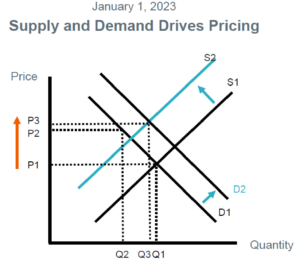

Abbe started with the question, “Why did everyone start talking about reinsurance late in 2022?” His answer started with a return to introductory economics — the law of supply and demand. As of September 30, 2022, global reinsurers’ capital dipped to $560 billion from $675 billion at end of 2021. Traditional equity returned to levels last seen in 2012, mainly driven by unrealized investment losses. This caused a contraction in reinsurance supply for renewals effective January 1, 2023.

Concurrently, primary carriers were experiencing increased inflation and the third consecutive year of elevated catastrophes, capped by Hurricane Ian making landfall in September 2022 in one of the costliest insured loss events on record globally. This increased demand for reinsurance as primary carriers sought to cede higher expected losses.

As any economic professor would tell their students, increased demand and reduced supply leads to higher reinsurance prices. Many ceding insurers accepted higher retentions to mitigate the higher reinsurance prices.

As we entered 2023, ceding insurers needed to incorporate the higher reinsurance expense alongside higher expected loss costs in their property rate filings, worsening the affordability of homeowners and commercial property insurance. Some primary carriers made the very tough decision to reduce their policies in force in high-risk markets, with approaches ranging from taking on less new business in those markets to exiting entire product lines.

The reinsurance industry then lived through 2023. P&C industry net combined ratio for primary insurers stayed above 100, driven by inflation and record severe convective storm (SCS) losses. Meanwhile, reinsurers’ financial results improved, with net combined ratio approaching 90, showing the benefit of increased cedent retentions — causing catastrophe losses to be largely retained by the primary market — and improved investment income. Global reinsurer capital rebounded by 8% as the 2024 renewal season approached.

Abbe then recapped 2024 and looked ahead to the future. He offered five key themes from reinsurance renewals effective January 1, 2024:

•Underwriting actions — Net retention increases paired with inflation and catastrophes drove increased primary carrier underwriting actions.

•Results disparity — Reinsurers outperformed primary P&C insurers, especially SCS-exposed regional carriers.

•Capital recovery — Strong reinsurer results resulted in improved supply/demand dynamics.

•Segment differentiation — Renewal outcomes varied by segment with peak perils (i.e., hurricane and earthquake) property catastrophe programs faring well, Midwest regionals facing numerous challenges, and overall ample casualty capacity available.

•Opportunity, optimism — Many reinsurers had unused capacity after January renewals were completed, so opportunities exist for primary carriers to fill gaps or find additional coverages.

Mid-year placements (heavily concentrated in Florida property exposures) were in the market at the time of this presentation, but early indicators were generally favorable. Pricing improvement and consistency in terms were common. Stronger reinsurer capital capacity, in part from 2023 earnings, contributed to broader appetite for larger lines with more flexibility for supplemental covers or lower coverage layers than in 2023.

Kunst started his primary property insurance market update by sharing research from the Insurance Information Institute (Triple-I). The industry experienced homeowners underwriting losses every year from 2020-2023, driven by loss-cost inflation and catastrophes. The 2023 net combined ratio was the worst since 2011. Net written premium growth of 12% is the highest in over 15 years, reflecting rate increases to offset higher losses due to inflation. Per Triple-I’s projection, loss experience is expected to improve in 2024 and 2025, but the industry is expected to remain unprofitable.

Kunst started his primary property insurance market update by sharing research from the Insurance Information Institute (Triple-I). The industry experienced homeowners underwriting losses every year from 2020-2023, driven by loss-cost inflation and catastrophes. The 2023 net combined ratio was the worst since 2011. Net written premium growth of 12% is the highest in over 15 years, reflecting rate increases to offset higher losses due to inflation. Per Triple-I’s projection, loss experience is expected to improve in 2024 and 2025, but the industry is expected to remain unprofitable.

Digging deeper, only three of the 20 largest homeowners groups achieved a 2023 net combined ratio below 100, and only four of the 20 had improved direct combined ratios in 2023 from 2022. Using CoreLogic’s replacement cost tools, homeowners estimated replacement cost values (RCV) increased cumulatively from 2020 to 2023 in the range of 22%-36% by state. This reflects inflationary loss costs and contributes to the increase in homeowners premiums.

RCV increases are being driven by types of both material and labor costs. When comparing November 2023 to November 2018, PVC pipe has gone up 125% while lumber increased by 5%, with several others clustered around 40% increases. That said, lumber had the greatest volatility in costs within the five years. Labor had lower variance by type, with lathers increasing 20% and carpenters at 15% across the five years, with significant volatility through the pandemic.

With regard to rising catastrophe losses, Kunst said the biggest underlying cause is the exposure growth — total number and value of homes and businesses where these catastrophe events are striking. This upward trend accelerated after 2005, driven by the number and cost of SCS events.

Wildfires are by their very nature immensely volatile. Fire suppression methods have improved, helping reduce the number of fires over the last two decades. However, acres burned and the number of structures destroyed are not trending down as more homes are built in the wildfire urban interface and severe events are still occurring.

Florida and Louisiana have been the two states with the worst homeowners insurance affordability metrics for many years running. In both states, it is the combination of climate risk, legal system abuse and inflation that has led to their current affordability and availability challenges.

California’s challenges, by contrast, are significantly impacted by regulatory restrictions which limit rate adequacy and underwriting accuracy. For example, primary carriers are not permitted to incorporate reinsurance expense into their homeowners pricing indications, which caused some of the market disruption when reinsurance prices spiked upward in 2023. Fortunately, the California Department of Insurance is working with the industry to modernize their regulatory regime.

Kunst concluded with two projections from the Triple-I:

•Industry underwriting losses are projected to continue for homeowners through 2025.

•Availability and affordability of property insurance will remain a concern in high-risk markets throughout 2024.

This general session provided a good overview of the combined primary insurance and reinsurance market dynamics contributing to these challenging times. Watching a replay of this live presentation is a worthy investment for anyone working on property product lines.

Dale Porfilio, FCAS, MAAA, is the chief insurance officer for the Insurance Information Institute and president of the Insurance Research Council.