Actuaries selecting loss trends for auto insurance should consider adding 2% to 3% for commercial auto liability and 0.7% to 1% for personal auto liability to account for increasing inflation, according to the report, “Increasing Inflation on Auto Liability Insurance — Impact as of Year-End 2023.”

Released by the Casualty Actuarial Society (CAS) and the Insurance Information Institute (Triple-I) in October, the report demonstrates the impact of rising economic inflation (as indicated by the Consumer Price Index) and social inflation. The CPI rose by an annual average of 5.6% from 2020 to 2023. During this period, the severity of personal auto liability losses increased by an annual average of 10.6%. The severity of commercial auto liability losses was also higher than the CPI, rising by an annual average of 6.4% (see chart).

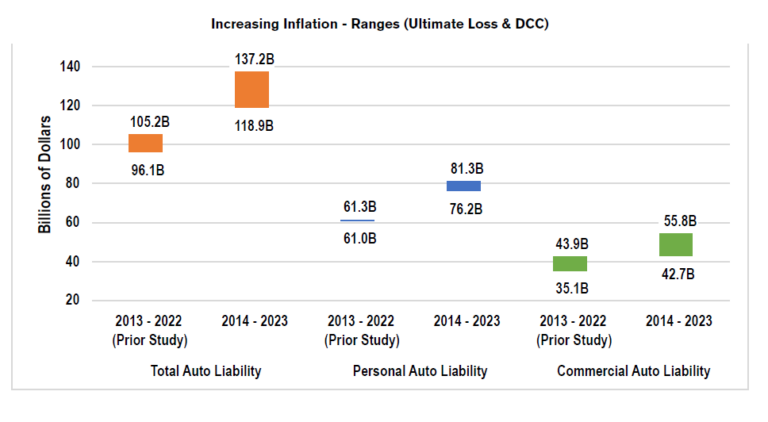

The pace of rising losses for the combination of personal and commercial auto liability lines has also intensified since the COVID-19 pandemic. Auto liability losses, along with defense and cost containment (DCC) expenses, increased by 9.9% to 11.5% of the $1.2 trillion in net losses and DCC between 2014 and 2023, which translates to a range of $118.9 billion to $137.2 billion in losses over the 10-year period. In comparison to the 2013-to-2022-decade, losses were $96 billion to $105 billion, reflecting a 24% to 31% increase in losses between the two periods.

For commercial auto liability, the increase in losses and DCC were a range of $42.7 billion to $55.8 billion, or 20.7% to 27.0% of the total — higher than the previous study’s range of $35 billion to $44 billion. Personal auto liability also experienced a significant impact, with increasing inflation driving losses and DCC up by a range of $76.3 billion to $81.3 billion. This represents 7.7% to 8.2% of the total, an increase from the previous $61 billion estimate for 2013 to 2022.

The report defines social inflation as “excessive inflation in claims.” Social inflation is closely tied to “legal system abuse,” which Triple-I defines as practices by policyholders or plaintiff attorneys that increase the cost and time required to settle insurance claims to the detriment of consumers. The report’s actuarial methodology combines both social and economic inflation, as it does not differentiate between the two underlying drivers.