The following article is solely the opinion of the author and does not reflect the views of her employer.

The years following the onset of the COVID pandemic, from 2020 to 2024, marked a prolonged hard market period in the insurance industry. Insurers were unprofitable during this period due to the increased frequency and severity of natural catastrophes and increased inflation driven by higher cost of vehicle repairs and property materials. As a result, insurers implemented more stringent underwriting criteria and rate hikes, leading to improved underwriting results.

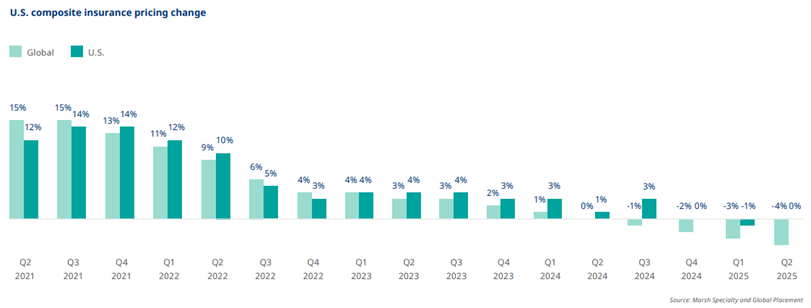

With the improved results leading into late 2024 and early 2025, an overall soft market has emerged, and the industry is seeing an increased appetite for growth, widespread rate decreases, and capacity increases across various lines of businesses. According to the Marsh Global Insurance Index, a measure of global commercial insurance rate change at renewal, rates have decreased by 4% in Q2 of 2025, the fourth consecutive quarter of declines.

With the improved results leading into late 2024 and early 2025, an overall soft market has emerged, and the industry is seeing an increased appetite for growth, widespread rate decreases, and capacity increases across various lines of businesses. According to the Marsh Global Insurance Index, a measure of global commercial insurance rate change at renewal, rates have decreased by 4% in Q2 of 2025, the fourth consecutive quarter of declines.

The general economic outlook describes the current conditions as a “soft market under stress” due to certain conditions that can cause the market to quickly tighten, such as geopolitical instability or climate change. A full insurance market cycle, encompassing both hard and soft phases, typically spans six to eight years. However, global professional services firm Aon predicts that this emerging soft market phase will be short-lived, hence “an insurance soft market landing.” The reality of the current cycle is also different for various lines of businesses. For example, personal property continues to experience hard market conditions, especially those in areas prone to natural catastrophes such as wildfires and floods. Personal auto is still observing hard market pressures due to persistent inflationary pressures and geopolitical risk from tariffs. Other lines of business, such as commercial lines, specialty, directors & officers, and cyber insurance, are reported to be in a soft market, where insurers are willing to offer broader coverage and higher limits.

What this means for actuaries:

In a “soft insurance landing,” organizations and actuaries need to approach this cycle strategically. Instead of engaging in transactional buying and aggressive sales objectives, insurers should consider adopting a total cost of risk approach. This would allow them to strengthen their programs, optimize capital, and build resilience to navigate volatility in the short term and until market conditions subside. Insurers who push the limit of their capital to respond to a soft market could potentially face rating downgrades and increased borrowing costs.

From another angle, actuaries should be aware of how actuarial methods could exacerbate insurance cycles. Pricing actuaries typically use historical data when determining future rates, which include time lags. Hence, good experience could keep prices low for too long and contribute to the soft market. Conversely, during periods of rising losses, rates may be inadequate for a period, leading to sharp rate increases and contributing to a delayed hard market. From a reserving perspective, estimates tend to be procyclical. Underestimation of losses during a soft market can encourage continued price competition, while overestimation of losses during a hard market can amplify the perception of poor performance, leading to more stringent underwriting, higher premiums, and reduced capacity across the industry, further delaying market corrections.

Sources:

- https://www.carriermanagement.com/news/2025/07/31/277956.htm.

- https://isure.ca/inews/hard-market-soft-market-insurance/.

- https://ar.casact.org/commercial-auto-and-workers-comp-the-neverending-story-of-two-remarkable-lines/.

- https://mma.marshmma.com/l/644133/2025-08-15/2vbkr4/644133/1755275654drZPwuf6/Q2_2025_BI_Market_Observations.pdf