Insurance professionals should assist in improving the public understanding of insurance and risk management.

—Canon 7 in the CPCU’s Code of Professionals Conduct

Sometimes it is frustrating to see that the public does not seem to appreciate the critical role insurance plays in everyday lives. This is especially true as increasing numbers of catastrophe events lead to rate increases and reserve uptakes. The public needs to know that the gloomiest night will give way to morning, and good things such as insurance will endure. And sometimes we need to remember what we truly bring to society as risk professionals.

“Insurance is far more than just a financial institution; It affects every aspect of people’s lives,” said Michel Dionne, the chief actuary of my employer, Aviva Canada. The following are several ways insurance currently contributes to society in recent years.

Catastrophe coverage

Looking through a macro lens, insurance takes its social responsibility seriously, ensuring its availability and affordability to the public.

At first glance, CAT coverage seems to go against the law of large numbers, making it an uninsurable risk. Infrequent by nature, CATs are difficult to predict accurately based on the mean estimation. There is a clear geographical concentration once a CAT occurs. Therefore, only people who live in risk-prone areas would be willing to purchase CAT coverages. Lacking a risk-sharing mechanism due to adverse selection would seem to make it close to impossible to diversify risks across a larger book.

But insurance does not just turn away and shut the door on offering disaster coverage. Take flood risk: In Canada, the insurance industry has been collaborating with the government over the years through the Task Force of Flood Insurance and Relocation to address rising flood risk. In the United States, private homeowners insurers are offering flood coverage to some homeowners traditionally covered by the National Flood Insurance Program and private carriers cover homes worth more than $250,000.21

In addition, the insurance industry has been quite vocal on the core issue around flood risk and continues to be a strong advocate, calling out emerging issues such as sea level rise and risk control approaches (updating flood maps with a fair level of accuracy and details, refining CAT modeling, and leveraging data from other sources).

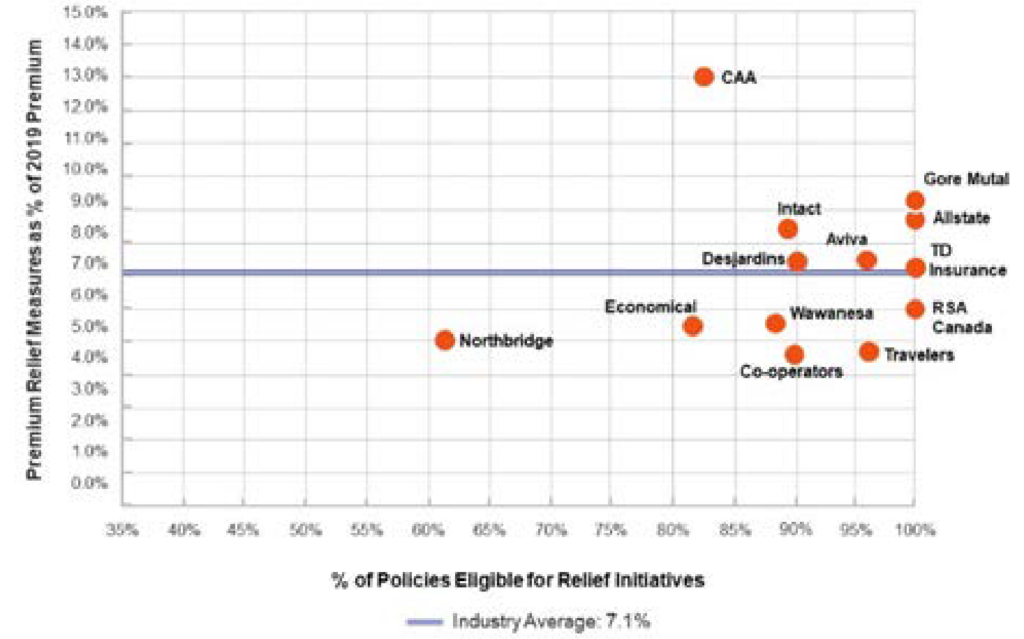

Figure 1. Premium Relief Measures as % of 2019 Premium — July 2020

Usage-based insurance

The insurance industry stands firmly for providing a fair rate for our customers at individual levels. Usage-based insurance (UBI) is a good example of how the insurance industry improves rate fairness by leveraging ongoing innovation and cutting-edge techniques.

As the Statement of Principles Regarding Property and Casualty Ratemaking says: A rate is reasonable and not excessive, inadequate, or unfairly discriminatory if it is an actuarially sound estimate of the expected value of all future costs associated with an individual risk transfer.

UBI technology allows insurance companies to track driving behaviors such as speeding and acceleration patterns, hard-brake habits, mileage and the time of day driving. Once policyholders download the app in their smartphones or install a small device in an insured vehicle, data collected will be directly fed back to insurance companies and taken into consideration while determining their insurance premiums.

UBI benefits society in various ways. It speaks to the heart of rate fairness by bringing in additional useful risk characteristics to identify good versus bad driving habits and by minimizing subsidization across risk classes. UBI also rewards good driving behaviors by offering premium discounts as immediate financial benefits to qualified insureds. And it encourages safe driving behaviors and promotes road safety in the long run, which, in turn, benefits society overall.

COVID-19 consumer relief

During the COVID-19 pandemic, public health officials around the world implemented lockdowns and other measures to reduce the chances of infection.

Massive lockdowns led to reduced auto claim frequency. Ontario auto insurers responded quickly with consumer relief actions at the onset of the emergency. From April 1, 2020, to April 1, 2022, the Financial Services Regulatory Authority of Ontario (FSRA) approved 108 emergency rate reductions and 45 emergency premium rebates in which 55 insurance companies participated.22 Under FSRA’s supervision, auto insurers voluntarily provided over $1.8 billion in consumer benefits, including rate reductions and rebates.23 Savings were returned to policyholders and helped ease financial pressures (see Figure 1).

In response to the changing driving patterns due to the stay-at-home orders, the insurance industry took initiatives to address auto rate fairness and ensure premium rates remained equitable to serve our customers during a challenging times.

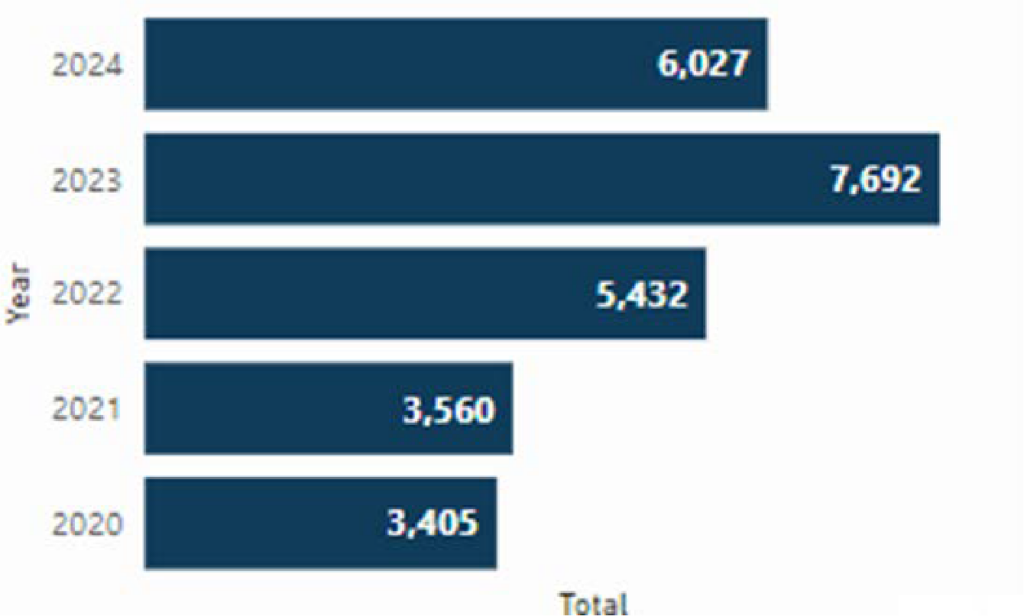

Figure 2. Total MCI by Year

Combating auto thefts

Many living in Ontario know someone who has recently experienced auto theft. Police data indicates that from 2021 to 2023 auto theft reports in Toronto alone were up more than 40% (see Figure 2).

A chain reaction of events during the pandemic led to the rise in auto theft. Supply-chain issues with elevated inflation led to the shortage of new car production, fueling a booming second-hand vehicle market including the re-selling of car engines. Tempted by its attractive profit margin, organized crime groups — professional criminals — came into the picture.

Higher auto theft rates led to higher frequency for auto comprehensive coverage, which in turn burdened all auto insurance policyholders with higher premiums.

To combat this crime-turned-national crisis, the insurance industry has been actively working with government and other key stakeholders to better protect consumers and their vehicles. Some auto insurers are offering Ontario customers an “approved anti-theft tracking system” known as TAG, at little to no cost for high-risk vehicle owners living in theft hotspots.24

As TAG becomes more widely used, its benefits could go beyond recovering stolen vehicles by further lowering theft claims frequency.

The problem of this type of auto theft will not be solved soon. Solutions, however, do require various parties working together to combat auto thefts. Insurance companies are helping to influence and equip society with a risk prevention and mitigation mindset.

Our duties

Working in the insurance industry gives us both the opportunity and responsibility to identify emerging risks and potential hazards, serving as the risk and control manager of the corporate world and society as a whole. As insurers, we never shy away from doing our part. ●

Yuhan Zhao, FCAS, is a senior actuarial manager for Aviva Insurance Company of Canada. She is a member of the AR Working Group and its Writing Subgroup.