CAS members excel at analytical, data-driven risk assessment, judging by whom we recruit to the profession, who passes the rigorous series of actuarial exams and who employs our 9,500 members and many more actuarial candidates. Despite all this success, Gleb Tsipursky — featured speaker at the 2022 CAS Spring Meeting — has identified another essential tool for our actuarial toolbox: behavioral science.

Tsipursky is a world-renowned thought leader in future-proofing, decision making and cognitive bias risk management in the future of work. He is CEO of the boutique future-proofing consultancy Disaster Avoidance Experts, which specializes in helping leaders avoid threats and missed opportunities. A best-selling author of four books and frequent speaker to a wide range of audiences, Tsipursky’s insights have been featured in over 550 articles and 450 interviews in prominent venues. His speech was based on his global best-seller Never Go With Your Gut: How Pioneering Leaders Make the Best Decisions and Avoid Business Disasters (Career Press, 2019). The CAS bought digital copies of his book for all attendees, as well as 100 paperback copies that he signed for attendees after the presentation.

Actuaries are often the unsung heroes in our organizations by providing the ounce of prevention that prevents the many pounds of cure through our risk management efforts. But sometimes our organizational stakeholders don’t make the best decisions. They might ignore our data-driven recommendations to the detriment of our companies, our departments and sometimes even our careers. Tsipursky attributes this shortsightedness to mental blind spots that behavioral scientists call cognitive biases, which cause people to misinterpret data, deny risks and make poor decisions.

Primer on behavioral science and cognitive biases

Following are quick definitions and descriptions of several key terms and concepts from behavioral science. The “framing effect” acknowledges that what we see and how we make decisions is powerfully shaped by how the information is presented to us. The same information can lead to different outcomes, depending on what is emphasized. How the information is framed can lead to risk denialism and poor decisions.

The “ostrich effect” describes the all-too-common intuitive response to deny risk, flinching away from unpleasant information about threats, problems and risk due to negative emotions. Disaster avoidance experts conducted a study of 286 organizations that fired their top leaders across four years. They found that 23% were fired for denying negative facts or risks to the peril of their organizations.

The “horns and halo effect” describes the human inclination to let our first impression of one characteristic about a person influence how we view all other characteristics. If we dislike the first characteristic, then its “horns” color everything else. If we have a positive initial view, the “halo” effect leads us to have too positive a view of the rest. This is especially challenging for actuaries trying to address risk denialism.

“Confirmation bias” reflects our brain’s preference to look for information that confirms our preexisting beliefs while ignoring information that contradicts them. It feels good to be right and bad to be wrong, so people don’t try to disprove their beliefs if this obscures the truth. This is apparent in how some people digest the news and how some business leaders receive actuarial analyses.

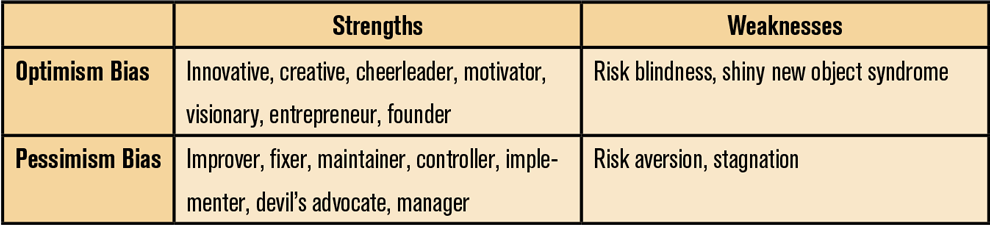

“Attentional bias” is when we focus on the most emotionally salient aspects of our environment, rather than on other factors and risks that may be just as important. In short, our minds pay attention to and emphasize what confirms our beliefs. This is especially important as we seek to develop high-performing teams, which optimally have a healthy mixture of staff with optimism and pessimism biases.

Why should you care about all of these behavioral science concepts? Because 90% of behavior and decisions are driven by emotions and only 10% by rational thinking, according to Tsipursky. People need to care about the situation before them and become emotionally invested in fixing these judgment shortcomings. To address these blind spots, research shows we need to:

- Identify where we fall into these mistakes.

- Recognize the pain points they cause us.

- Develop an emotional commitment to protect ourselves from these pain points.

- Take specific research-based steps motivated by these emotions to overcome cognitive biases.

Tsipursky closed this segment of his presentation by encouraging the audience not to take on too much at once. Treat all of these cognitive biases as a menu of options and choose the one that seems most urgent to address in the short term. Decide what concrete steps can be taken to address it and try it out. If it works, identify other low-hanging fruit from the menu. If it doesn’t work, try variations until you achieve some progress.

Time for application of behavioral science to actuarial science

Tsipursky shared several techniques to overcome one or more of the cognitive biases he described. He led off with five key questions for avoiding decision disasters:

- What important information did I not yet fully consider?

- What dangerous judgment errors (cognitive biases) did I not yet address?

- What would a trusted and objective adviser suggest I do?

- How have I addressed the ways this could fail?

- What new information would cause me to revisit this decision?

He provided a simple calling card with these questions, keeping them close at hand to consider as we seek to improve how we present our recommendations and participate in key decision making.

He then transitioned to the key problem of how to deal with risk deniers. While actuaries are wired to start from data and analysis, he told us to “stop simply stating facts and risks. It won’t work if people deny obvious risks. Don’t give in to the temptation to argue and assume emotional blocks are at play.”

Instead of arguing solely from the facts, Tsipursky introduced the acronym EGRIP (emotions, goals, rapport, information and positive reinforcement) as an alternative approach.

Emotions

When someone denies obvious facts and risks, it’s safe to assume their emotions are to blame. Deploy empathy by seeking to understand their emotions. Identify their emotional blocks and pain points so you can address them in the next steps.

Goals

Establish shared goals. Put yourself on the same side. Doing so is key to building trust and sharing knowledge effectively so they truly listen to you.

Rapport

Build trust by establishing rapport. Show you understand their emotions by using empathic listening and echoing their emotions. Show you share the same goals and care about their interests.

Information

Provide new information that challenges their beliefs. Frame it within your shared goals but be careful about their emotional blocks and pain points. Show how their current beliefs are not aligned with your shared goals. Focus on how your shared goals can be better achieved if they change their beliefs, while making sure new information can help them overcome their emotional blocks and pain points.

Positive reinforcement

After the person shifts their perspective, provide them with positive reinforcement. This will help shift their emotions on the topic and help them be more oriented toward the truth, so they don’t have to go through this emotional labor-intensive process too often.

Tsipursky closed his presentation by reemphasizing how actuaries can be the heroes of the post-COVID recovery if we can complement our excellent data-driven risk management with the ability to address cognitive bias risks. He challenged all attendees to commit to applying one of his methods to a work situation during the following week, whether that be targeting a specific cognitive bias, using his five key questions to avoid a decision disaster or applying the EGRIP mnemonic. He gave us new tools for our toolbox. Now it’s our responsibility to put them to use.

Dale Porfilio, FCAS, MAAA, is chief insurance officer for the Insurance Information Institute.