When I first started my actuarial career in Malaysia, I had to a make a tough decision between joining a well-established life insurance company or a start-up general insurance (GI) consulting firm. Just to set the scene, here were some of my considerations from back in 2010.

- It was common to have about 20 to 50 staff in the actuarial department of a life insurance company but GI companies can operate without having a proper actuarial department as most of the work can be outsourced to a consulting firm for a small fee.

- Most actuaries were already heavily involved in the daily operations of a life insurance company, not just within the traditional actuarial function but also in other areas, including more senior management roles. On the other hand, there were not many experienced GI actuaries to look up to as a mentor.

- Actuarial roles were pretty much regulatory-driven. GI actuaries were mainly needed to perform and sign off on loss reserve analysis as part of the local regulatory requirement. In terms of pricing, only medical and health insurance products require that an actuarial certification be prepared and signed by a GI actuary.

- Motor and fire (homeowners and commercial property) insurance makes up about 70 percent of the premium written across all GI companies in Malaysia. Insurers have been restricted by a tariff that has not been revised since 1978, so they can only work on segmentation to underwrite the more favorable risk, which can be done by a team of technical underwriters or a portfolio management team.

- With the increasing claim cost, motor insurance became more competitive and the local market had to tighten their underwriting guidelines in order to remain profitable. However, this contributed to a growing residual pool (for the higher risks that are not able to get motor coverage in the local market) in which losses are equally shared by all GI companies.

A key message from the regulatory body is to make sure that no insurance companies fail.

Despite the advice from my seniors and peers, I chose to go for the road less taken, a riskier path. Fast forward six years later, now we can see more and more actuarial involvement in GI companies. This involvement escalated with the intention to liberalize the motor and fire insurance rates in 2016 to better suit customers’ needs and the regulation requirement for an in-house appointed actuary in every GI company by 2017.

Today, many out of the 30 GI companies have already set up an actuarial function, mostly for the ongoing pricing and reserving work. In terms of pricing, it will be a very new experience for most of the local GI actuaries having to set motor and fire rates for the first time in the market. But the Central Bank of Malaysia, which is the regulatory authority, is very careful to make sure that the industry is ready for this. Hence, implementation will mostly likely be phased in rather than having a full-blown detariff in 2016.

A key message from the regulatory body is to make sure that no insurance companies fail. It is imperative that the local actuarial profession constantly monitor the financial health of companies, whether it be providing sufficient reserves or setting reasonable pricing rates.

Kuala Lumpur Hosts Second Ratemaking Seminar

The Casualty Actuarial Society, the Actuarial Society of Malaysia (ASM) and the Institute of Actuaries of Australia jointly organized the General Insurance and General Takaful Ratemaking Seminar to address the needs of the GI actuarial profession. The seminar was held in Kuala Lumpur on September 21-23, 2015, and it attracted more than 70 actuarial professionals from across the region. The event marked the second time that the CAS and the ASM had collaborated.

The seminar began with welcome remarks from ASM President Wan Saiful and CAS Past President Mary Frances Miller. Attendees shared their experiences dealing with data issues and technical pricing, and managing management’s expectations. One of the initial concerns for the industry is the lack of pricing experts and that many of the smaller players tend to lose out, primarily because of a lack of credible data for any sophisticated pricing work and higher operating expenses due to lower business volume. Some participants argued that smaller players can go for a niche market and that it is easier for them to adapt to detariffication. Multinational companies tend to rely on regional or global support while local companies can only resort to hiring experts to join the company. Another interesting discussion concerned how to structure the actuarial function in terms of reporting line and scope of work.

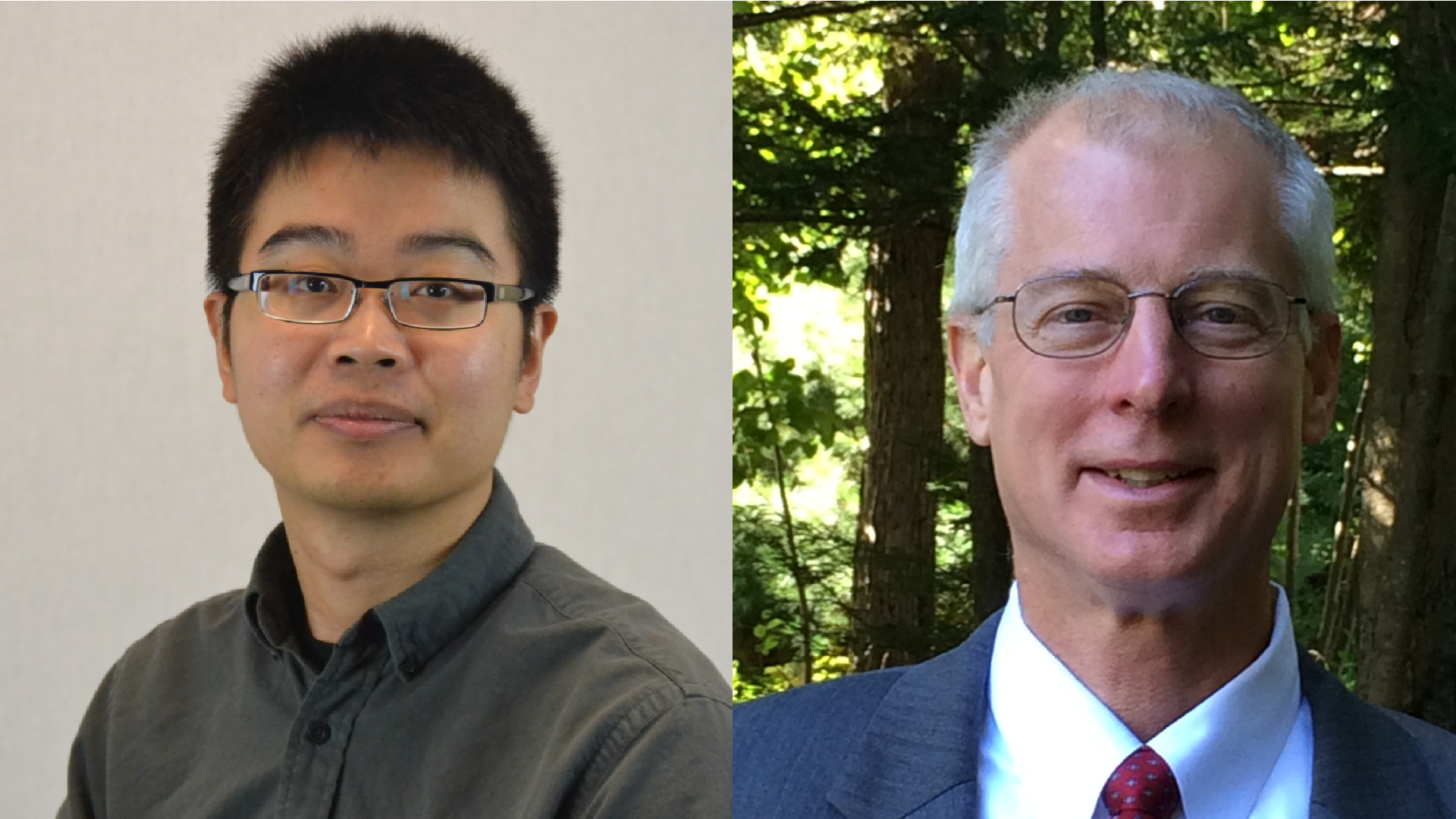

ASM Vice President Kelvin Hii and CAS Past President Bob Conger were chief organizers of the seminar.

Shze Yeong Ong, FCAS, is a general insurance actuary for AIA Berhard in Kuala Lumpur.