The CAS and the Institute and Faculty of Actuaries (IFoA) have issued a joint research paper for analyzing international property per risk exposures that is now available for download.

The CAS and the Institute and Faculty of Actuaries (IFoA) have issued a joint research paper for analyzing international property per risk exposures that is now available for download.

Titled “Analyzing the Disconnect between the Reinsurance Submission and Global Underwriter’s Needs,” the research aims to fill the void in current actuarial literature related to requirements for primary and reinsurance pricing practitioners.

Topics addressed in the paper include:

- Analyzing various “amounts of insurance” definitions typically used worldwide.

- Analyzing the impact of each of the traditional property risk characteristics (standard COPE — construction, occupancy, protection, and exposure).

- Producing robust price monitoring systems.

- Using information typically included in cat model submissions.

The paper’s intent is to illustrate the importance of each of these data elements and to be a reference document for all parties to the insuring transaction.

In 2015 the U.K. Institute and Faculty of Actuaries General Insurance Research Organization (IFoA-GIRO) and the Casualty Actuarial Society’s Casualty Actuaries in Reinsurance (CAS-CARe) jointly formed a GIRO working party to produce this reference source for use by underwriters, actuaries and other pricing practitioners internationally.

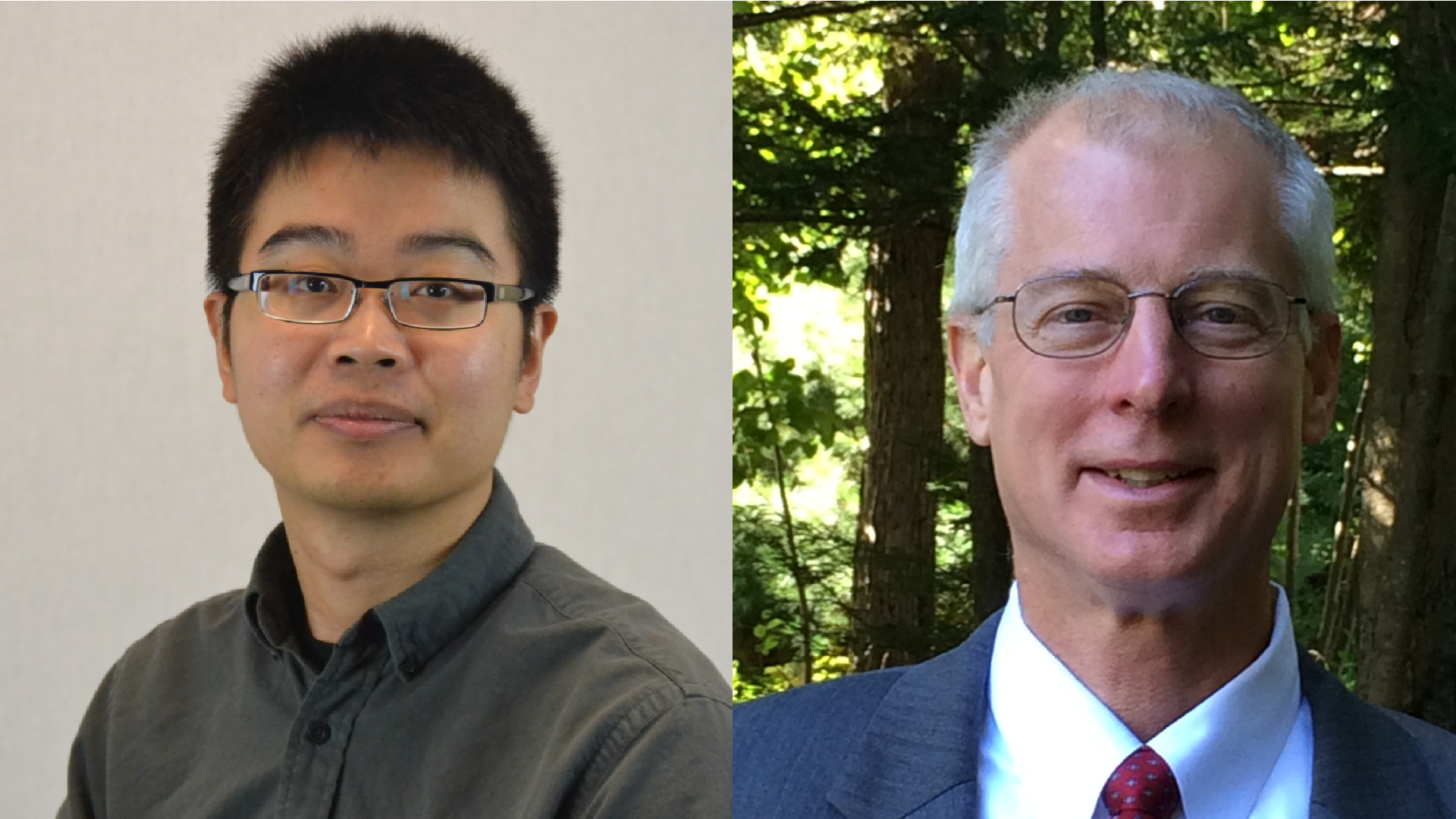

The results of this GIRO Working Party reference document will be presented at the Boston CAS/CARe Seminar on Reinsurance, June 6-7, 2016, by two of the authors: John Buchanan, FCAS, MAAA, and Chris Boggs.