“An uncollected invoice may be the tipping point between a profit and a loss of a business enterprise.”

—Something that anyone wanting to purchase this product should know.

Trade credit insurance in its simplest form is business-to-business accounts receivable (AR) insurance protecting the insured (the seller or the policyholder) against the risk of losses arising from a buyer’s failure to pay the amounts due to the insured. Accounts receivable is debt created when a seller delivers goods but is awaiting payment by the buyer, like an IOU or a loan. Alternatively, this may also be known as “selling on credit terms,” a low-cost form of financing for buyers to boost sales.

In the world of retail trade, the seller ships their products to their customers (buyers) who in turn sell those products in their stores. Buyers typically delay payment 60-120 days — the average time that it takes to move the products off their shelves. Buyers often need this time to generate cash flows to repay the sellers. Imagine a situation where the buyers must pay for all goods in their stores prior to the sales and how difficult that would be in the world of trade. It is also important to note that these transactions are not collateralized, so the seller considers the buyer’s repayment history as assurance that the owed monies will be paid in due course.

If all goes as planned, the seller will be reimbursed by the buyers in the time frame stipulated in the contract. However, there could be situations where the buyers do not pay the sellers on time or never at all owing to reasons, such as:

- difficult business situations.

- bankruptcy.

- poor financial management.

- lack of product demands.

Luckily, for sellers, the insurance marketplace has created a product, often termed “whole turnover/multi-buyer, trade credit insurance,” to mitigate the risk of not receiving payment in a timely manner.

Imagine a situation where the buyers must pay for all goods in their stores prior to the sales and how difficult that would be in the world of trade.

Each year, a seller could deal with any number of buyers, both those who already have relationships with the seller and those who are new to the seller. A trade credit policy typically provides insurance on named buyers whose credit worthiness has been determined acceptable by the insurer. In addition, the insurer will also offer a discretionary credit limit (DCL) for any unnamed buyers that the seller will deal with during the policy term. The DCL is usually much smaller than the limit offered on the named buyers. Given the lack of information on the unnamed buyers at policy inception, a comparatively low DCL helps shield the insurer against potential high-severity losses while still affording the seller a level of risk protection.

In addition to the DCL, there are potentially other policy features put in place to share the loss with the insured, such as:

- an aggregate deductible.

- 10%-20% coinsurance.

- individual buyer deductibles.

Sellers with a strong balance sheet and a cash surplus may choose to “stand on their own cash flows,” meaning they would not use a bank for their financing needs but still use trade credit insurance as a mechanism to ensure they are made whole in the event of a buyer default. However, many sellers require financing support or a revolving line of credit from a bank to facilitate smooth operations. Because of the time lag in collecting payments from their buyers, a seller often establishes a financing facility from a bank to maintain manufacturing the product lines, pay for cost of goods and the like. In turn, these banks may require proof of trade credit insurance on the seller’s accounts receivable as a precursor to providing financing. In this way, a seller with trade credit insurance can secure bank financing at terms that are more attractive.

In recent years, the basic trade credit policy has evolved to offer additional coverage that can include:

- liquidity protection.

- capital relief.

- increased transactional capacity.

- policy compliance.

- regulatory requirements.

- residual value covers on leasing arrangements.

- export credit.

Some of the larger deals have been completed on a syndicate basis, where multiple carriers take a share of the overall limits.

When underwriting a potential insured, the insurance company typically considers the industry, previous loss history, current aging of receivables, internal credit practices of the firm, geography/political situation, macroeconomic environment and the financial standing of the buyers. An understanding of the buyers’ financial strength is paramount, so insurers typically assess financial strength using in-house risk rating models, as well as financial metrics from external agencies, such as S&P, Moody’s, Fitch and D&B DRS Score. Based upon these metrics, a risk score is produced that is used to rate the exposure. It’s essential that the exposure represented by the group of buyers is fully analyzed and quantified from a risk perspective. A weighted average risk score determines the final insurance premium paid. In the United States, this is typically an admitted product requiring rate filings; however, there are instances of trade credit insurance being non-admitted.

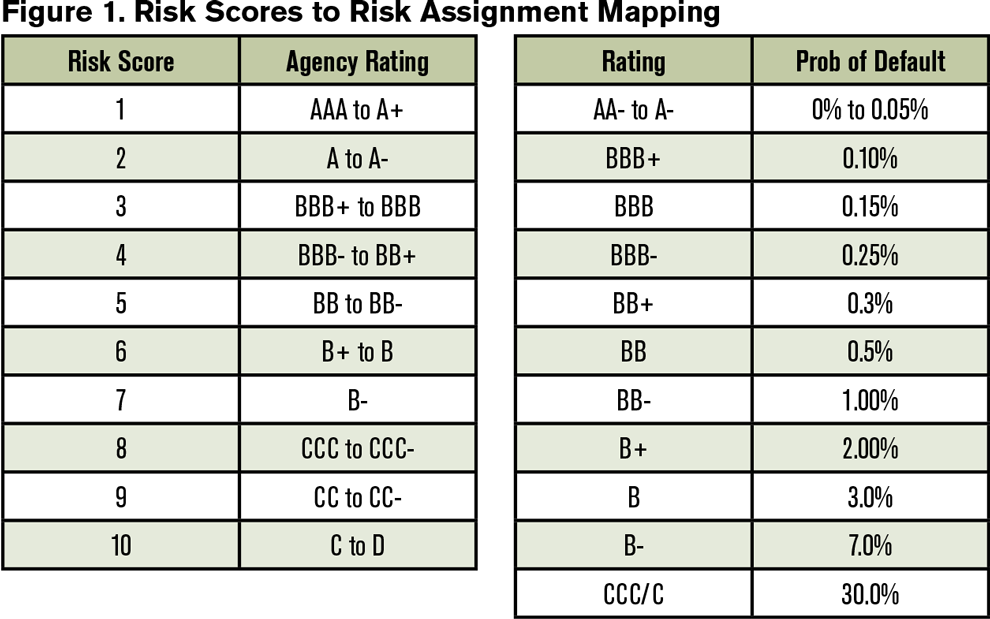

For an illustration, a potential mapping of the risk scores to risk assignment and the expected probability of default are shown in Figure 1.

The expected loss cost of this product hinges on three components: exposure at default (EAD), probability of a customer default (PD) and loss given default (LGD). For example, the exposure at default can be determined by actively monitoring the in-force portfolio or using a long-term usage rate of 60% of limit capacity, or both. The probability of default, a key part in this equation, can come from internal/external risk rating models as in the example shown in Figure 1. The LGD is an amalgamation of policy features and any potential recoveries. And it can range anywhere from 20% for a well-collateralized portfolio to 100% for a fully uncollateralized portfolio, offsetting any coinsurance or deductibles.

Expected Loss Cost = EAD * PD * LGD.

To summarize, trade credit insurance has the potential to address these three major needs:

- Mitigate risk of nonpayment such as bankruptcy/protracted default or cross border risks.

- Increase sales by winning new customers and/or extending more competitive terms.

- Enhance financing such as improved borrowing terms and quicker cash flow that are required by banks as additional protection or capital relief.

The loss ratios for a whole of turnover business typically run in the low- to mid-50s and offers an attractive return for an insurance carrier. The one caveat to note is the marginally higher capital requirements from a balance sheet perspective, owing to the uncollateralized nature and the proneness to react to economic peaks and troughs. The loss ratios tend to be much more favorable in better economic conditions and worse during economic recession or a slowdown.

With a global market size of $7.0 billion (U.S.’s share is $1 billion), the potential for this product line will continue to evolve and offer a good diversification benefit for global insurance carriers!

Maheswaran Sudagar, FCAS, is senior vice president, lead actuary, for Crum & Forster’s surety, credit and program solutions.