The Professionalism Education Working Group often gets asked to clarify if the Code of Professional Conduct and the Actuarial Standards of Practice (ASOPs) apply to various scenarios. While the articles will be posing scenarios as they apply to credentialed actuaries, we feel that these could apply to anyone doing work of an actuarial nature, regardless of whether they intend to become credentialed.

To make this truly a learning and professionalism experience, we want your feedback. You can send your comments and questions to ar@casact.org.

The Applicability Guidelines for Actuarial Standards of Practice serve as a valuable resource for actuaries practicing in the U.S. Published by the Council on Professionalism and Education of the American Academy of Actuaries, these guidelines aim to assist actuaries in identifying which Actuarial Standards of Practice (ASOPs) might provide guidance on common assignments. They do not impose any mandatory compliance on actuaries, but rather offer non-authoritative guidance on the ASOPs that could be relevant to specific tasks. The guidelines are periodically updated, and it is the actuary’s responsibility to stay current with changes to the ASOPs and ensure their professional services align with the applicable version of each ASOP. While not binding, these guidelines play a role in promoting professionalism within the actuarial community, helping actuaries make informed decisions in their practice.

The Applicability Guidelines is an Excel file, with six tabs: Cover, Introduction, Casualty, Life, Health and Pension. The Cover tab includes basic information on what the American Academy of Actuaries is, but most importantly, it notes the revision date of this document. The Introduction tab gives a brief summary of the document, including the definition of ASOPs and Applicability Guidelines. Most of the key information has been summarized in the introductory paragraph of this article. The last four tabs: Casualty, Life, Health and Pension, list each of the major practice areas for actuaries. And of course, the Casualty tab will be most relevant to members of the CAS.

Focusing on the Casualty tab, we see that there are relevant ASOPs listed for each of the seven major practice assignments, which are:

- Appraisals

- Data Management

- Enterprise Risk Management

- Expert Advice, Witness and/or Testimony

- Financial Analysis, Projections and Reporting

- Product Development/Ratemaking/Pricing

- Reserving

For each of these practice assignments, relevant ASOPs are shown so they can be easily referenced. Note that at the top of the tab, ASOPs 1, 23 and 41 are always applicable.

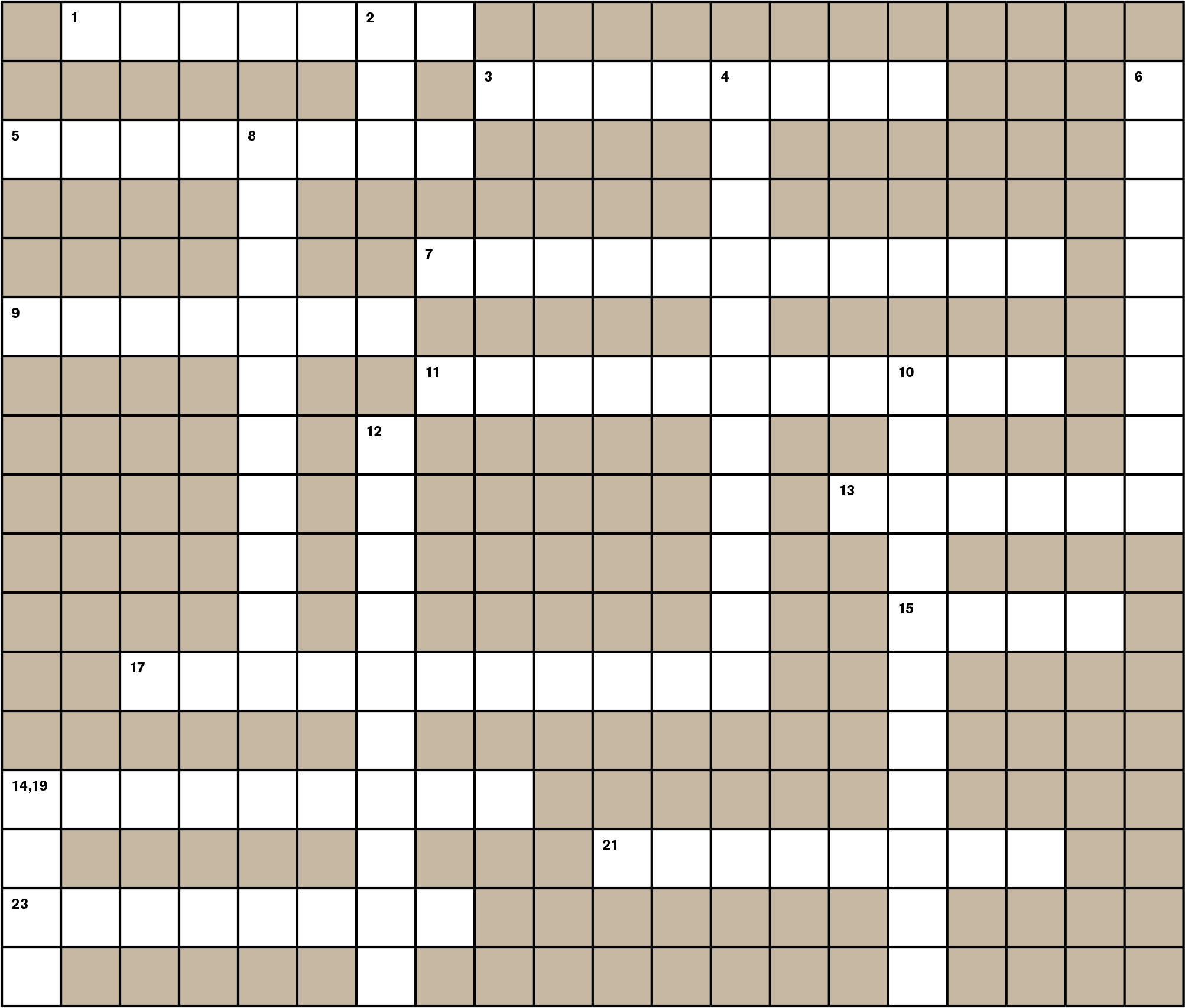

We have designed a puzzle for the Casualty practice area, and specifically Product Development / Ratemaking / Pricing that includes ASOPs 1, 7, 11, 12, 13, 20, 23, 25, 29, 30, 38, 39, 41, 53, and 56.

You can find the most current version of the Applicability Guidelines on https://www.actuary.org/content/applicability-guidelines-actuarial-standards-practice-0.

Across

1 (ASOP 53) Examples of Intended _____ include mean, the mean plus risk margin, the high or low estimate within a range of reasonably possible outcomes, and a specified percentile of the distribution of reasonably possible outcomes.

3 (ASOP 13) Consider _____ and social influences that can have a significant impact on trends.

5 (ASOP 13) A procedure to estimate future values by analyzing changes between exposure periods.

7 (ASOP 25) In carrying out credibility procedures, the actuary should consider the _____ of both the subject experience and the relevant experience.

9 (ASOP 41) Actuarial _____ is defined as the result of actuarial services, including advice, recommendations, opinions or commentary on another actuary’s work.

11 (ASOP 39) A relatively infrequent event or phenomenon that produces unusually large aggregate losses.

13 (ASOP 38) Focuses on standards for actuaries using _____ outside their area of expertise.

15 (ASOP 30) It is defined as an estimate of the expected value of future costs.

17 (ASOP 25) A measure of predictive value that the actuary attaches to a particular set of data.

19 (ASOP 39) A lack of independence between the occurrence of losses among different entities.

21 (ASOP 30) It is a measure of the relative amount of risk to which capital is exposed, typically expressed as the ratio of an exposure measure, such as premium or liabilities, to the capital amount.

23 (ASOP 41) An actuarial _____ includes all actuarial communication in any recorded form. However, notes taken by someone other than the actuary are not considered.

Down

2 (ASOP 56) Model _____ is the process of transforming a particular set of input to a particular set of output in a model.

4 (ASOP 12) Risk characteristics should be selected that can be determined _____.

6 (ASOP 29) It includes these five components (1) loss adjustment costs, (2) commission and brokerage fees, (3) other acquisition costs, (4) general administrative costs and (5) taxes, licenses and fees.

8 (ASOP 7) A contract is any security that derives its value from underlying financial instruments.

10 (ASOP 38) Communications and Disclosures mention “Documentation,” “ _____ Information” and “Disclosures.”

12 (ASOP 23) Containing enough data elements or records for the analysis

14 (ASOP 23) Confidential information should be handled consistent with Precept 9 of the _____ of Professional Conduct.

Did you solve the puzzle? Send us a picture of it to ar@casact.org!