Property-casualty insurers continue to struggle with inflation. The Consumer Price Index (CPI) rose by 7% in 2021 and 6.5% in 2022, the biggest annual increases since 1981.

As an actuarial topic, inflation has come into and gone out of focus as the phenomenon itself has waxed and waned. One of the better-known looks came from a paper that spent almost two decades on the Syllabus of Examinations. Robert Butsic’s “The Effect of Inflation of Losses and Premiums for Property-Liability Insurers” provides a detailed, though not always straightforward, look at how inflation permeates insurance operations. The insights, inelegantly reached, continue to be important for a practicing actuary:

- Rising interest rates provide insurers some insulation from a spike in inflation (just not as much as Butsic seemed to believe).

- If unanticipated claims inflation exceeds unanticipated general inflation, insurance results suffer.

- If interest rates exceed claims inflation, insurance results benefit.

Butsic’s paper also has some unstated lessons to impart:

- To create a successful model, actuaries have to thoroughly understand the process they are modeling. Butsic needed to think about when an insurer collects premium, invests funds and pays claims, and how inflation affected each of these in different ways.

- Actuaries need to consider their work as part of a larger insurance operation, not just within a pricing/reserving silo. In that way, Butsic’s work draws a direct line to the present-day actuary — an important cog in the holistic management of an insurance operation.

Butsic wrote his paper in 1981, the year before the CPI for all Urban Consumers (CPI-U) rose by 12.5%. It had exceeded 4.8% in the previous seven years.

The paper looked at inflation’s effect on the typical actuarial jobs of the day: pricing policies and estimating. But it went further. It examined how inflation changed investment income and skewed the entire balance sheet.

It entered the syllabus just a year after publication, on Exam Part 10. The exam tested “the breadth and depth of the candidate’s understanding of the insurance process.”

Within Part 10, the paper was included in a section testing knowledge of Financial Operations of Insurance Companies — “the various relationships that exist between underwriting results, investment income and taxes that arise out of the underwriting process and total operating income.”

The paper was about inflation, yes. But it envisioned an actuarial career broader than pricing and reserving. The Syllabus Committee, by putting the paper on the financial operations syllabus, not on the pricing or reserving exams, seemed to be saying actuaries need to develop the strategic skills that will make them leaders of the entire operation.

The paper remained on the syllabus through 1999 when exams were reconfigured.[1] Inflation by then was under 3%.

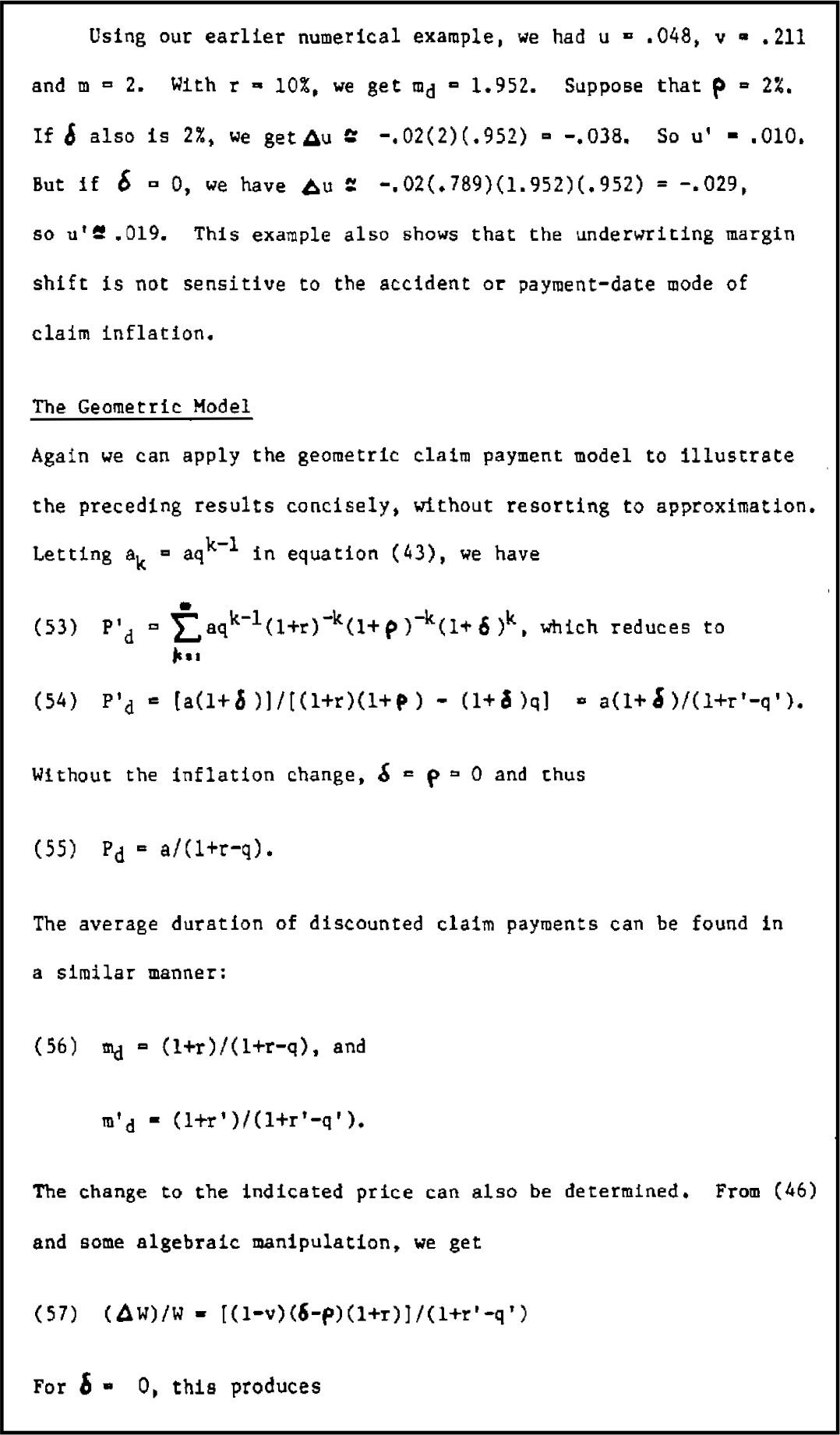

Butsic’s paper is quaint. He wrote it on an old-fashioned typewriter. The paper’s Greek variables — Δ, δ, α, ρ, β, Σ — and the inequality operator, ≥, are scribbled in by hand.

He was working before personal computers permeated the workplace. The most powerful computer of the 1980s was the Cray supercomputer series, which helped the U.S. government on nuclear weapons research.

You wouldn’t find one on an actuary’s desktop, though. A single one costs around $6 million. It weighed 55,000 pounds.

By today’s processing standards, though, it was a runt. A six-ounce iPhone 12 is 5,000 times faster. To keep up with that iPhone, you’d need a stable of Crays weighing 27.5 million pounds, or more than every Division I college football player combined.[2]

Lacking the CPU heft, Butsic had to develop an algebraic model to show how pricing, reserving and investments all affected insurance results. His model was complex. I counted 34 variables.

Tracking 34 variables can be a slog. Forty years later, it may seem like Butsic introduced more variables than necessary. But his task was enormous. He modeled an insurer’s entire financial operation: pricing, reserving, investments, balance sheets and cash flow. He didn’t have a Lenovo desktop, or a Cray-2 or even an iPhone.

He had a typewriter. And it couldn’t type Σ.

I say all that to help the reader understand how the article is valuable even though its primary conclusion, “Insurers are, to a large extent, insulated against unanticipated changes in rates of inflation,” proved incorrect. He seems to have gotten some stuff wrong, but he got a lot right, too.

His argument: Inflation raises claim costs, but insurers benefit from the higher interest rates at which they can invest. In most cases, he says, the benefits outweigh the costs.

Butsic leaned heavily — too heavily I’d argue — on the Fisher effect, the 1930 hypothesis that the nominal interest rate equals the sum of the real interest rate and the inflation rate. Citing the Fisher effect, he argues that “The effect of the claim inflation rate is exactly offset [emphasis his] by an equivalent change in the interest rate” at which claims are discounted. In other words, inflation rises today, interest rates rise tomorrow.

In the real world, insurers are hit with inflation the day prices rise. The benefit from interest rates follows considerably later. As today: Despite general inflation exceeding 6% for two consecutive years, the interest rate on two-year Treasuries — two years being a decent proxy for the duration of property-casualty claims — only rose about 2.5 percentage points.

Even in Butsic’s day, the Fisher effect wasn’t robust. In commentary accompanying Butsic’s paper, Rafal J. Balcarek pointed out that real interest rates after taxes had been negative for the previous 15 years, through 1980.[3]

Butsic also underemphasized the impact of rate regulation. If an insurer discovers inflation in their portfolio today, another year or more might pass before a regulator will approve higher rates.

For Butsic, the impact of inflation was also affected by the nature of the business being written. He modeled inflation using an accident year model and a calendar year model.[4] In his accident year model, inflation after the policy incepts doesn’t affect the size of a claim. In his calendar year model, it does.

Consider a policy you wrote this year expecting a single $100 claim next year. Suppose there is a 10% inflation spike. Under Butsic’s accident year model, the claim would still be $100. Under the calendar year model, the claim would cost $110.

All policies, he suggested, operated according to a weighted average of the two models. Auto physical damage and workers’ compensation indemnity payments follow the accident year model, he writes. Workers’ compensation medical and products liability follow the calendar year model. Others fall in between.

Business that operates under his accident year model has an inflation hedge. Business that follows his calendar year model … not so much.

Maybe things were different in 1981. Except for workers’ compensation’s scheduled benefits, the accident year model doesn’t seem realistic today.

His accident year model, in my mind, resembles a fixed annuity, where the amount paid in each period is set by the terms of the contract, regardless of any inflation that occurs after the policy incepts. Most property-casualty policies try to make the indemnified parties whole, putting them in the same condition they occupied before the insured event occurred. That includes an adjustment for inflation — the calendar year model.

Whether he was correct, he was thinking hard about the process and how inflation would affect different types of policies. For example: He introduced a variable, d, the claims cost accelerator. Multiplying it by the duration of claims outstanding will estimate the impact of inflation on a reserve portfolio.[5]

He acknowledges that if claim costs rise by more than inflation, premiums will be inadequate, perhaps substantially. Proving that there is nothing new under the sun, Butsic says insurers could be vulnerable to “‘social inflation,’ where claim payments would increase as a result of non-economic [emphasis his] influences.”

That won’t happen too often, he suggests. Most policies, he asserts, are a blend of his accident year and calendar year models. So normally, claim costs will rise by less than the inflation rate. In that case, “the insurer will be better off … (Discounted) investment income will rise faster than incurred claim costs.”

Butsic’s assumptions — that most policies are a mix of the accident year and calendar year models and that interest rates rise in near lockstep with inflation — skew his conclusions, probably in the wrong direction.

And the cost of claims rises at a different rate than overall inflation. For example, auto replacement costs for personal and commercial auto rose more than 40% from 2019 to 2022, according to the Insurance Information Institute. In that time, general inflation rose just under 16%. Interest rates haven’t risen enough to cover any of those costs.

It is easy to be critical. But actuaries of the 1970s and 1980s had primitive tools compared with today. Today we wouldn’t have to develop an extended alphabet to algebraically model an insurance operation. We’d write it in Python or stuff it into a spreadsheet. We wouldn’t have to mail the Bureau of Labor Statistics to obtain the guts of an inflation report. We’d just Google it and download.

Better data and more advanced technology let us build more nuanced, robust models. And they let us spend more time questioning assumptions and back testing outputs. The result: better understanding of pricing, reserving and everything else to do with insurance operations.

Jim Lynch, FCAS, MAAA, is retired from his position as chief actuary at Triple-I and has his own consulting firm.

[1] Part 10 was phased out. Some of its topics were spread to the reserving exam (Part 6 then) and financial analysis exam (Part 8).

[2] Data on the Cray Computer from Fast-forward — comparing a 1980s supercomputer to a modern smartphone | Adobe Blog. For the record: The 5,000 Crays would have weighed 27,500,000 pounds. There are 254 Division I football teams, each with up to 125 players. Assuming the average football player weighs 300 pounds (he doesn’t), that’s 9,525,000 pounds.

[3] Balcarek’s commentary was formally added to the syllabus in 1993, 11 years after the Butsic paper.

[4] Butsic uses the terms accident date and payment date. I think my terms make it easier to follow the logic.

[5] Simply put, d is the size of the inflation spike. If inflation has been 2% and climbs to 6%, d = 4%, approximately.