In today’s rapidly evolving insurance landscape, predictive analytics has become a cornerstone of innovation and efficiency. Professionals across the industry — including actuaries, data scientists, underwriters, and claims specialists — are recognizing the importance of enhancing their skill sets with advanced data modeling and machine learning techniques to stay ahead in a competitive field. The Certified Specialist in Predictive Analytics (CSPA) credential offers a pathway to deepen expertise, opening new career opportunities and amplifying contributions to organizations.

“The shift to ‘Big Data’ in risk management is transforming the insurance landscape,” says Alicia Burke, iCAS director of portfolio & product development. “More than 60% of P&C insurers are now ‘data-driven,’ and predictive modeling has increased profitability for more than 80% of companies.”

While this article focuses on two actuaries who advanced from ACAS to CSPA, it’s important to note that the CSPA credential can benefit professionals from a wide range of backgrounds within the P&C insurance sector. Whether you are an actuary, data scientist, or underwriter, if you have an interest in data and predictive analytics, the CSPA credential can help drive your career forward.

Among those embracing this opportunity are Jay Call and Bobby Jaegers, both CAS Associates who have pursued the CSPA to augment their actuarial knowledge with advanced predictive analytics skills. Their experiences shed light on the value the CSPA brings to professionals navigating the complexities of modern insurance challenges.

“… what I have noticed since completing my CSPA is that more of those career opportunities are tailored to my unique skill set as a predictive modeler.” —Jay Call

For Call, the decision to pursue the CSPA was driven by a desire to stay at the forefront of industry developments. “Like other members of the CAS I have talked with, the number of recruiting solicitations I received skyrocketed shortly after completing my ACAS,” he observes. “But what I have noticed since completing my CSPA is that more of those career opportunities are tailored to my unique skill set as a predictive modeler.”

Jaegers’s journey began with a fascination for predictive analytics during his college years. Insurance companies, with their vast amounts of data, presented an ideal environment for applying advanced analytical techniques. “It was kind of an aha moment,” he recalls. “When I found out about the CSPA credential, it was right up my alley — it got me back into the side of actuarial science that really excited me.”

The CSPA credential complements traditional actuarial skills by providing a comprehensive toolkit for tackling complex problems. Call found immense value in the modeling techniques covered, particularly those in Exam 3, which focus on advanced methods like Ridge and Lasso regression. “I appreciate the CSPA’s focus on effective visual communication of technical concepts,” he adds, highlighting an often overlooked but crucial aspect of the profession.

Jaegers notes that the credential has broadened his capabilities beyond traditional actuarial tasks. “You’re not confined to basic ratemaking techniques — you can expand into other avenues, like helping out underwriting or claims departments,” he says. The CSPA has equipped him with the fundamental knowledge to analyze rate filings and discuss predictive analytics with confidence, an asset in his role reviewing filings for state insurance departments.

Both actuaries emphasize the direct applicability of CSPA skills in their daily work. Call, who had traditionally relied on generalized linear models (GLMs), recognizes the growing relevance of more sophisticated techniques. “Ridge and especially Lasso penalty methods are becoming increasingly popular improvements to GLMs, as they provide a way to incorporate credibility considerations,” he explains. “Tree-based methods are becoming more relevant and are frequently able to capture nonlinear signals more easily than GLMs.”

Jaegers found that the credential enhances his ability to dissect complex models presented in regulatory filings. “The CSPA has given me a lot of that fundamental knowledge needed to look at the filings companies submit,” he remarks. “It has enhanced my ability to understand these filings and discuss predictive analytics confidently.”

Earning the CSPA has also helped both actuaries stand out within their organizations and the broader industry. Call envisions the credential as a standard for his team. “I would like all the actuaries working for me to achieve their CSPA one day,” he states. “I believe it provides practical insights about modeling best practices and offers perspective on balancing business needs with technical skill and clear communication.”

Within his company, Jaegers has become a go-to expert in predictive analytics. Colleagues seek his insights into complex issues, and the credential has bolstered his confidence. “The CSPA has really helped me gain confidence in discussing complex topics and articulating them in ways that aren’t jargon-heavy,” he reflects.

The increasing demand for predictive analytics in the insurance industry is reshaping risk assessment and decision-making processes. From pricing and underwriting to claims management and fraud detection, predictive analytics is becoming indispensable. ACAS-credentialed professionals are recognizing that enhancing their skills in this area is essential to staying competitive and meeting evolving industry needs.

“The CSPA has really helped me gain confidence in discussing complex topics and articulating them in ways that aren’t jargon-heavy.” —Bobby Jaegers

“The CSPA credential is meticulously designed to equip professionals with deeper expertise in data modeling, machine learning, and the practical application of predictive analytics in insurance,” Burke explains. “It benefits data scientists, actuaries, underwriters, claims professionals and others in roles involving data analysis, risk management and predictive modeling.”

The credentialing process involves several components, including exams that cover statistical learning, data visualization and advanced modeling techniques. Waivers are available for certain exams based on prior qualifications, allowing candidates to tailor their credentialing pathway to their background and experience.

A cornerstone of the CSPA is the Case Study Project, which provides candidates with the opportunity to apply their knowledge to real-world challenges. This project is not prescriptive; instead, it encourages candidates to approach problems using the tools and methods that make the most sense to them.

“This approach looks different from other credentialing programs,” Burke notes. “Candidates may request a mentor for guidance and receive personalized feedback, with the option to correct and resubmit their work. It fosters growth and learning, which is essential in a field that is constantly evolving.”

Jaegers, now the chair of the CSPA Project Committee, highlights the unique value of this approach. “We don’t give you a set of steps to follow,” he explains. “It’s more about how you would approach the problem using the tools that make the most sense to you. The feedback we give is tailored to be helpful without being overly directive, making it a great learning opportunity.”

The integration of predictive analytics into the actuarial profession offers unprecedented opportunities for growth and impact. As demonstrated by Call’s and Jaegers’s experiences, the CSPA credential equips actuaries with advanced skills that not only enhance their expertise but also open new career pathways. For members seeking to advance their careers and make a meaningful impact within the property and casualty insurance industry, pursuing the CSPA credential is a strategic move toward remaining at the forefront of industry developments.

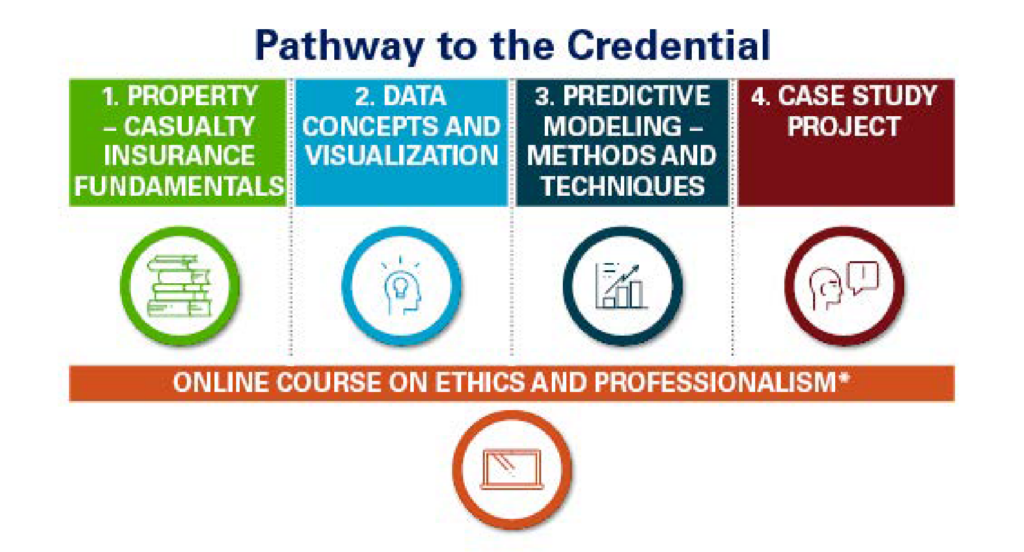

The five steps to the CSPA credential

Our five-course path is your gateway to mastering predictive analytics in insurance. Each step prepares you for the technical challenges of data science in the P&C insurance field.

- Property-Casualty Insurance Fundamentals

Exam 1: Covers the core principles underlying property-casualty insurance and risk management, introducing the primary concepts needed for analyzing and modeling P&C data and risks.

- Data Concepts and Visualization

Exam 2: Covers foundational data preparation and management techniques for quantitative analysis, predictive modeling and data analytics in P&C insurance.

- Predictive Modeling – Methods & Techniques

Exam 3: Explores advanced statistical analysis, predictive modeling, and data analytics tools for P&C insurance applications, focusing on multivariate regression, statistical modeling and machine learning.

- Case Study Project

This project assesses the application of knowledge and skills from the first three exams in areas such as claims, underwriting, pricing, marketing, risk management and operational performance. The project integrates the option for a mentor with the opportunity for feedback and revisions.

- Ethics & Professionalism

This course explores ethical behavior essential for maintaining trust in insurance professionals. Using case studies, it outlines ethical expectations and focuses on upholding public trust in insurance transactions.

Visit our site to learn more about waivers available to eligible candidates.

To learn more about the CSPA credential and how it can enhance your actuarial skill set, visit the CAS Institute website. Embracing predictive analytics is more than staying current—it’s about shaping the future of actuarial science and the insurance industry. At iCAS, progressing is a passion.