Record-high inflation, unrealized investment losses, climate risk and war in Ukraine made 2022 a dynamic year. To top it off, Hurricane Ian made landfall in September as the second most costly natural catastrophe in U.S. history, contributing to the most challenging January 1 reinsurance renewal season since the World Trade Center terrorist attack in 2001. If the economy goes into recession in 2023 — as many business leaders expect — how will the insurance industry react?

Record-high inflation, unrealized investment losses, climate risk and war in Ukraine made 2022 a dynamic year. To top it off, Hurricane Ian made landfall in September as the second most costly natural catastrophe in U.S. history, contributing to the most challenging January 1 reinsurance renewal season since the World Trade Center terrorist attack in 2001. If the economy goes into recession in 2023 — as many business leaders expect — how will the insurance industry react?

The first general session of the 2023 CAS Spring Meeting featured two speakers sharing their perspectives on the state of the industry. Brian Brown, principal and consulting actuary at Milliman, Inc., shared forecasts for the major lines of business in 2023-24 and key risks across multiple product lines. Matthew Mosher, president and CEO at AM Best, shared how technology and a more volatile environment is changing the insurance industry and actuarial work.

Brown led off the session with P&C industry underwriting projections jointly prepared by the Insurance Information Institute (Triple-I) and Milliman. The industry’s 2022 net combined ratio deteriorated to an underwriting loss in 2022 following four consecutive years of small underwriting profits. The industry’s combined ratio is forecast to incrementally improve in 2023 and 2024 but remain an underwriting loss. Poor performance in personal lines, most notably personal auto, is the single biggest driver of the 2022 through 2024 results.

Digging deeper on personal lines, the industry’s personal auto net combined ratio spiked to 112 in 2022, 10 points worse than 2021 and 20 points worse than 2020. Cumulative inflation in repair costs cause the 2023-2024 forecasted results to remain at an underwriting loss, while necessary rate increases are fully earned. Homeowners results are driven by inflation in repair costs and the third consecutive year near $100 billion of insured catastrophe losses, most notably Hurricane Ian. Loss pressures and expected catastrophes indicate greater rate increases are needed to restore homeowners to an underwriting profit.

Turning to commercial lines, the industry’s commercial auto net combined ratio swung back to an underwriting loss in 2022, leaving 2021 as the only underwriting profit since 2010. General liability is performing slightly better, with underwriting profits forecast in 2023 and 2024. Workers’ compensation is the brightest spot among major product lines. Workers’ comp produced another strong underwriting profit in 2022, continuing the pattern of favorable results from 2015 through the 2024 forecast horizon.

Brown then pivoted to key challenges facing the P&C insurance industry. He led with social inflation (referred to as “legal system abuse” by some), which he believes is the most significant issue facing the industry. He defined social inflation as the rising cost of claims that cannot be explained by economic inflation. This makes it difficult to estimate future loss trends and drives adverse loss development, most notably in liability coverages.

He elaborated on three key drivers for social inflation:

- Change in jury attitudes.

- Plaintiff attorneys developing new strategies.

- Third-party litigation funding (TPLF).

Studies have shown that current jury pools have a lower opinion of big business, in part driven by the mortgage crisis of 2007-2008. These opinions are strongest among younger generations (e.g., millennials). Some people see jury service as a way to right social wrongs and redistribute wealth. Empirical evidence suggests jury awards are highest in areas with greater income inequality.

Plaintiff attorney strategies include:

- Reptile theory — popularized in the 2009 book by a trial attorney and jury consultant — focusing on how to make juries feel fear toward defendants.

- Blaming the organization for the behavior.

- Anchoring tactics — high amounts suggested by plaintiff attorneys to create a baseline for jury awards.

- Specialized conferences and better communication among plaintiff attorneys.

- Advertising promoting large awards.

According to research by Swiss Re Institute, U.S. television advertising by attorneys has tripled in the last decade. More importantly, “a lack of policy and enforcement of existing regulations has allowed some attorneys to manipulate advertising in ways that usurp and trivialize the justice system with asymmetric information. This is contributing to the rise of nuclear verdicts (in excess of $10 million) in the trucking industry.”

His third key driver of social inflation was TPLF, when investors (who otherwise would have no financial interest in the case) provide up-front funding to the plaintiff attorney in exchange for a percentage of the final settlement. According to Bloomberg, the TPLF industry is estimated to be worth $39 billion, and Swiss Re estimates that TPLF companies are earning a return of 25%. With this scale and return, Brown predicts TPLF will remain a key risk for the insurance industry.

Most concerning, TPLF arrangements are only required to be disclosed in two states (prior to 2023 when two additional states passed disclosure legislation with future effective dates) and approximately a quarter of judicial districts. TPLF involvement in any case is usually unknown to the defense, their attorneys, judges and juries, and the investors’ economic incentives can influence the amount and timing of cases.

Brown closed his part of the session with a review of products and coverages, where various actuarial metrics and awards of $10 million or more have been impacted. If one works in hospital professional liability, commercial auto, directors and officers (D&O) or cyber, the presentation will likely provide deeper insights than this brief article will capture. (Visit the CAS Online Learning Center for recordings from the 2023 Spring Meeting.)

Mosher then took a deeper dive into demographic shifts, climate-related trends, technology, capital markets, inflation and social norms all impacting the state of the insurance market. For example, the U.S. is experiencing an increasing comfort with technology, in part because approximately 20% of our population was born after the introduction of the iPhone (2007). This is projected to rise to 50% by 2050. Simultaneously, big data, machine learning and the internet of things (IoT) are allowing insurers to approach risk in new ways.

Technology innovation and data explosion creates an accelerated pace of change for P&C actuaries. Complexity and greater competition (both within and from outside the insurance industry) are key factors driving the use of technology among different business lines. Specific changes include telematics, predictive modeling, increased regulatory scrutiny, complex loss trends and improved catastrophe modeling.

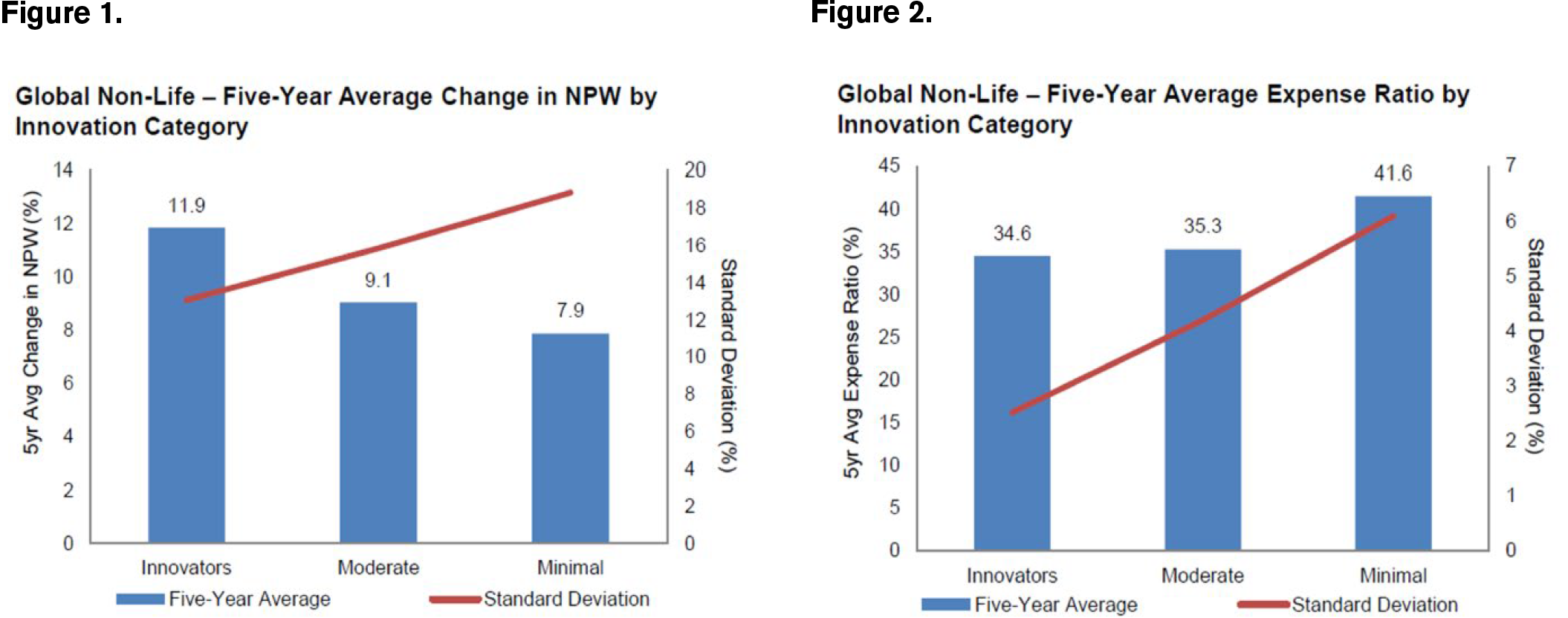

AM Best performed a study of the growth rates and operational efficiency of global non-life insurers based on their level of innovation. As captured in Figures 1 and 2, high innovators achieved significantly higher growth in net written premium while simultaneously incurring lower average expense ratios. This creates a competitive advantage for these innovators and allows for more competitive prices to policyholders. AM Best is observing the highest levels of innovation in reinsurance, health and auto.

Insurtech companies have been a source of much innovation and competition in recent years. From 2012-2022, overall insurtech funding was approximately $50 billion, split roughly 60% in the P&C sector and 40% in life and health. However, increasing macroeconomic headwinds in 2022 resulted in the first contraction in insurtech funding since 2016.

Hardening reinsurance markets place pressure on certain insurtech business models, such as quota share treaties to reduce required capital amounts. Venture capital is becoming scarcer with increased expectations on profitability versus growth toward scale. That said, the technology value proposition is just as valid today as it was in years past.

Technology and partnerships can be key differentiating factors in the insurance value proposition. For example, carriers can include technology-based services within their cyber insurance product offerings:

- Highly specialized managing general agents with delegated underwriting authority and exceptions.

- Surface scanning and cyber security recommendations.

- Continuous risk management and intelligence monitoring.

- Incident response pre- and post-claim services to speed response and resolution.

Other technology-based product examples include insurance-linked security offerings and embedded insurance.

Mosher concluded by sharing his perspective on what this all means to actuaries. First, companies need to adapt. “They need you to look for the innovation to be successful in dealing with these dynamic times,” he said. “If they’re not moving forward and dealing with this change, they’ll be on the short end of the stick when it comes to competition down the road.”

Second, these new risks and challenges create opportunities for individuals and companies. “Learn something new and build on that in your career,” he said. Third, the core responsibilities of actuaries remain important. He closed by saying, “We need to stay focused on ultimate losses, proper pricing and proper reserving. That’s the most important part to your industry. How will you consider these changes in meeting your responsibilities?”

Dale Porfilio, FCAS, MAAA, is the chief insurance officer for the Insurance Information Institute.