The voice of the U.S. actuarial profession on public policy and professionalism issues—the American Academy of Actuaries (Academy)—was established in 1965 by the U.S.-based actuarial organizations, including the Casualty Actuarial Society. Its mission is to serve the actuarial profession and the public. By fostering professionalism, actuaries more effectively serve the public, that is, actuarial services meet a high standard and promote the financial stability of the economy. By providing public policy commentary, actuaries demonstrate that they are more than just number crunchers. They are knowledgeable of societal systems, and thus public policy commentary enhances the reputation of actuaries. This article delves into the crucial role the Academy plays in promoting professionalism among actuaries and advancing public policy issues. It also highlights some recent initiatives applicable to property-casualty actuaries.

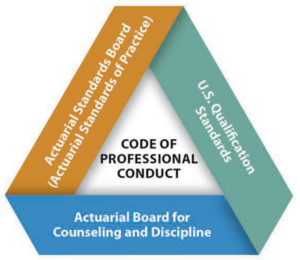

The Academy provides for the establishment, maintenance and enforcement of high professional standards of actuarial qualification, practice and conduct. Through the Code of Professional Conduct,[1] the U.S. Qualification Standards,[2] the Actuarial Standards Board (Actuarial Standards of Practice)[3] and the Actuarial Board for Counseling and Discipline,[4] the Academy is committed to maintaining the highest standards of professional conduct among its members, ensuring their expertise is consistently utilized with integrity and transparency. The core of the Web of Professionalism[5] is the Code of Professional Conduct, which outlines ethical principles and responsibilities that actuaries must abide by. This Code addresses conflicts of interest, client confidentiality, competence and the obligation to communicate effectively with stakeholders. By adhering to these guidelines, actuaries foster trust and confidence in the integrity of their work. By having these four components of the Web of Professionalism, actuaries protect their status as a self-regulated profession.

Continuing education and professional development

The U.S. Qualification Standards set forth continuing education (CE) requirements for U.S. actuaries. The Academy supports the requirements by providing access to workshops, webinars, symposiums and conferences to enhance skills and knowledge on professionalism topics and public policy issues impacting its members and the public. This ongoing commitment to providing diverse and cost-effective professional development ensures that actuaries have access to the knowledge that keeps them at the forefront of their profession, offering high-quality services and insights to their principals and the public.

The U.S. Qualification Standards set forth continuing education (CE) requirements for U.S. actuaries. The Academy supports the requirements by providing access to workshops, webinars, symposiums and conferences to enhance skills and knowledge on professionalism topics and public policy issues impacting its members and the public. This ongoing commitment to providing diverse and cost-effective professional development ensures that actuaries have access to the knowledge that keeps them at the forefront of their profession, offering high-quality services and insights to their principals and the public.

Advancing public policy

Public policy

The Academy actively calls for sound public policy related to actuarial issues. By liaising with elected officials, regulators and other policymakers, the organization helps shape federal, state and sometimes international legislation and regulation that directly and indirectly impact how actuaries work. Using the expertise of its volunteers, the Academy offers thoughtful and actionable commentary on issues across practice areas. This involvement extends to areas such as health care, Social Security and pensions, life insurance and property-casualty insurance. By contributing to the formulation of well-informed policies, the Academy helps safeguard the financial security and well-being of individuals and businesses.

Research and publications

The Academy promotes research and publication of actuarial studies and insights, fostering the exchange of ideas and appropriate practice among actuaries as well as providing information for our public stakeholders. Feature articles in Contingencies magazine, white papers, professionalism discussion papers and research documents are the vehicles for spreading these insights, enhancing the profession’s collective understanding of complex issues. This commitment to research helps actuaries and public stakeholders make appropriate decisions and aids the Academy in providing more supported views on public policy work products.

Specific property-casualty initiatives

The Academy, both through specific committees of the Casualty Practice Council (CPC) and through what the Academy terms “cross-practice” efforts, focuses on areas of interest to CAS members. Included below are some examples of the Academy’s public policy activities that CAS members may find interesting.

Extreme events—Wildfire

Extreme events—Wildfire

Just as the CAS has focused on wildfire at its 2023 Spring Meeting with breakout sessions and a film, the Academy also has wildfire top of mind. To provide a base knowledge for public policymakers who are dealing with various aspects of this issue, the Academy’s Extreme Events and Personal Lines Committee published an issue paper on wildfire[6] covering the wildfire peril, the current state of modeling and pricing for the wildfire peril, California laws in particular, and insurance impacts through 2021. That was not the last word on wildfire, however. A lot has been happening recently related to insurance availability as well as mitigation and adaptation efforts of communities and insurers, keeping wildfire an ongoing focus.

Identifying bias in data

Identifying bias in data

The Academy recognizes that data is core to actuarial work. In today’s world, the available data has expanded to include big data as an additional source of information for actuaries. Data may be biased due to the way it is collected and used, as well as how actuarial models are designed, built and implemented around the data. The Academy’s Data Science and Analytics Committee is active in providing tools for actuaries to understand the definition, impacts and consideration of bias in data through a recent issue brief.[7] Bias introduced by artificial intelligence and machine learning has the potential to be identified by actuaries, and thus this ability to identify bias is added to the actuarial toolkit.

Defining ”unfair discrimination”

Through the CPC’s P&C Committee on Equity and Fairness, the Academy provides independent actuarial perspective on equity and fairness topics and insurance practices that potentially disadvantage people of color and other groups. As an example, the CPC has been liaising with the Colorado Division of Insurance on regulation tied to a law that relates to unfair discrimination in insurance practices, offering an actuarial perspective on proposed regulations as that state considers how best to protect its policyholders from unfair discrimination.

Actuaries play a crucial role in assessing the long-term effects of climate change on risk exposures, pricing, underwriting and financial reporting practices.

Climate change

Climate change

As climate change and individual climatic events pose increasing challenges to the U.S. financial security system, the Academy is addressing its impact across the spectrum. While property-casualty insurers and actuaries are well aware of the physical risks of climate change, they are in a position to lead actuaries in other practice areas to an understanding of climate risks. Actuaries play a crucial role in assessing the long-term effects of climate change on risk exposures, pricing, underwriting and financial reporting practices. The Academy has collaborated with the National Oceanic and Atmospheric Administration (NOAA) and the National Science Foundation (NSF) to open dialogue between catastrophe modelers and climate modelers with the goal of increasing the accuracy of both kinds of models. Academy members have access to the recordings of a series of webinars from this collaboration.[8]

Cyber risks

Cyber risks

The CPC has developed and continues to build out its Cyber Risk Toolkit, a series of papers addressing issues pertinent to cyber risk insurance and cyber exposure. This toolkit is intended to be a resource for interested readers of the general public, public policymakers, the actuarial profession, the insurance sector and other stakeholders. The Toolkit offers a cohesive overview of the challenges posed in the cyber insurance market, covering the basics of the cyber landscape, autonomous vehicles, cyber terrorism and the role of digital assets in cybercrime, to name a few.[9]

Lisa Slotznick, MAAA, FCAS, retired from PwC in 2022, where she served as managing director.

[1] https://www.actuary.org/sites/default/files/files/code_of_conduct.8_1.pdf

[2] https://www.actuary.org/sites/default/files/2021-11/USQS_2021.pdf

[3] http://www.actuarialstandardsboard.org/standards-of-practice/

[5] The Academy and the Web of Professionalism: Key elements of the professionalism infrastructure of the U.S. actuarial profession, https://www.actuary.org/sites/default/files/files/imce/WebOfProfessionalism2017.pdf

[6] https://www.actuary.org/sites/default/files/2022-02/Wildfire.2022_.pdf

[7] https://www.actuary.org/sites/default/files/2023-07/risk_brief_data_bias.pdf