William Wilder’s goals are to modernize the CAS admissions requirements to reflect the evolution of actuarial practice and to continue improving the experience for candidates.

As VP-Admissions, he is responsible for all aspects of the CAS admissions process and is a leader to the nearly 600 volunteers who support this work. He works closely with CAS Admissions staff and acts as the senior connection point between the staff and volunteers. Wilder reports directly to the CAS Board, who delegated him the responsibility of approving final selected pass marks for every exam.

Wilder’s ongoing goals relate to basic syllabus and exam processes such as syllabus updates, exam construction and grading, and results releases.

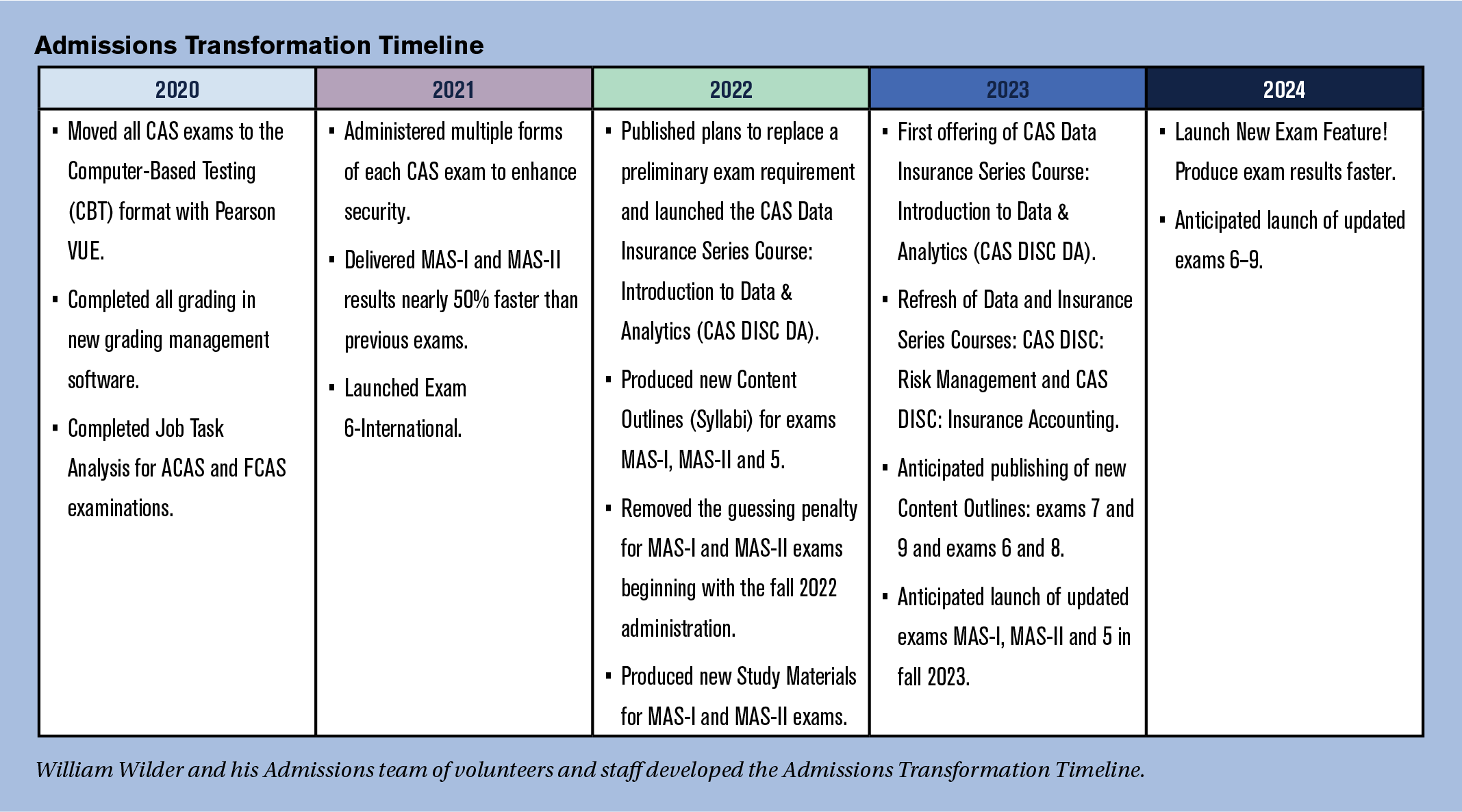

“Since about the time I stepped into this role in late 2020, we have had a significant initiative in flight called the Admissions Transformation Plan (ATP),” Wilder said. “A key component of modernizing admissions requirements, as announced at the Spring Meeting in Boston, our plan is to introduce a requirement for candidates to complete a predictive analytics project.”

Wilder particularly liked the way the predictive analytics project brought together such a diverse group of experts and the partnership between Admissions and the CAS Institute (iCAS).

“I’m also excited about the continuing improvements we’re making to our candidate experience, like introducing time for a 15-minute break during the exam when the clock will pause and expanding availability of practice tests in the testing environment,” he said.

“We had to skip a sitting back in 2020, but we came back with computer-based testing years ahead of schedule and never looked back,” Wilder said.

Wilder is also pleased with the improvements the organization is making to the processes and tools. For example, a new item-writing development tool has been launched that integrates with the CAS’s item-banking platform. Introducing new item-types will increase efficiency with the organization’s volunteer grading resources.

Like many other volunteer leaders, Wilder is most proud of the way volunteers and staff weathered the massive disruptions brought about by the pandemic.

“We had to skip a sitting back in 2020, but we came back with computer-based testing years ahead of schedule and never looked back,” Wilder said. “I’m also proud of the way staff and volunteers have come together in the past couple of years and how we’ve expanded opportunities for CAS members to get involved in ways beyond writing, grading and syllabus support.”

Wilder started volunteering for the Exam Committee immediately after achieving his Fellowship in 2001 and has been involved in the admissions area ever since. He started writing and grading exams and then became the vice chair of his committee. He then took on a series of leadership roles from part chair to general officer to assistant chair and then chair of the full Syllabus and Exam Committee. Before being appointed as vice president, he was also elected to serve three years on the CAS Board.

“This has not only given me an opportunity to give back and keep my skills current, it’s given me a broad professional network and a number of colleagues whom I also consider to be good friends,” Wilder said.

Before he jumped into the actuarial profession, Wilder was an educator, and education has always been a passion of his.

“It’s why I volunteered for the Syllabus & Exam Working Group right after I got my FCAS,” Wilder said. “I was also specifically excited about all the initiatives and challenges the CAS was taking on in the wake of the pandemic.”

“As someone who was deeply familiar with the volunteer leadership team and also familiar with recent board priorities, it felt like a good fit,” he said. After his board term ended, Wilder decided to take some time off from volunteering. Then the Nominating Committee got in touch with him in early 2020 about taking on the VP role. “I realized that taking time off wasn’t what I really wanted after all.”

Wilder took a circuitous route to becoming an actuary. After teaching at the college level, he had planned to pursue a Ph.D. in mathematics. But Wilder met some real actuaries, and he remembered his high school guidance counselor’s advice to pursue the actuarial field.

“I sat for the preliminary exams, got 10s, and before I knew it, I landed my first job as an actuarial assistant,” Wilder said.

With his focus on commercial products, Wilder progressed through the ranks at several insurance companies. He enjoyed commercial specialization business because of its complexity and its need to have both good analytical skills and an understanding of the specific requirements and challenges of the various market segments.

Most recently, Wilder joined EY thanks to some introductions arranged by his colleague and fellow CAS volunteer, Kathy Odomirok. This is Wilder’s first work in consulting, and he is finding it a good fit.

“We’re growing and expanding our service offerings within P&C actuarial consulting, and it’s been professionally gratifying to be a part of that,” Wilder said. “I get to solve interesting and impactful problems, interact with loads of smart and dedicated people from diverse backgrounds and experiences, and develop my professional skills while experiencing good work/life balance and an opportunity to give back to my profession and the common good. What more could I ask for?”

Wilder encourages those who want to pursue a volunteer leadership role to start by getting involved as a member of a working group or task force.

He advocates Admissions as a good place to start. “There are lots of opportunities . . . we have so many volunteers and such a robust organizational structure and leadership team,” Wilder said. “There’s a genuine opportunity to progress and develop leadership skills that can help in your career beyond volunteerism.”

The views expressed in this article are solely the views of William Wilder and do not necessarily represent the views of Ernst & Young LLP or other member firms of the global EY organization. The information presented has not been verified for accuracy or completeness by Ernst & Young LLP and should not be construed as legal, tax, or accounting advice. Readers should seek the advice of their own professional advisors when evaluating the information.