Explore how transparency, communication, and emerging technologies can help rebuild trust and strengthen the insurer–insured relationship.

The following article is solely the opinion of the authors and does not necessarily reflect the views of their employer or school.

The modern word “insurance” comes from enseurance, a word from Old French meaning assurance or pledge. Insurance is a pledge of financial protection from an insurer to an insured in times of need. In exchange for that promise, the insured provides a premium and disclosure of necessary information for the insurer to make a proper risk assessment. In essence, the parties rely on each other to be honest and upfront to create the best outcomes for both.

In recent years, public trust in the insurance industry has become a pressing concern. In the media, the attacks on insurance company CEOs in late 2024 and early 2025 highlight rising tensions. Further, billboards along American roads and mass tort advertisements conspicuously encourage litigation against insurance companies. Meanwhile, schemes attempting to defraud insurance companies have become just short of commonplace. These developments warrant a closer look at the mutual pledge that defines the insurance industry.

Why should insurance companies care about trust? A strong foundation of trust not only promotes customer loyalty but strengthens the industry’s reputation and perpetuates stability in the marketplace. According to J.D. Power’s 2024 Auto Insurance study, “90% of auto insurance customers in the high-trust category say they are likely to renew their policy with the same insurer versus just 30% in the low-trust category.” In the same study, “the average trust score among customers who experience an insurer-initiated increase — but who fully understand the reasons for that increase and expect the increase — is the same as the average trust score among customers who experienced an insurer-initiated decrease.” It is clear that trust can go a long way in building a relationship between the insurer and the insured.

This article explores how the insurance industry fares in terms of trust, examines the role both the insurer and the insured play when trust breaks down, and offers actionable steps to bridge the gap to build a more trustworthy future.

The state of trust in the insurance industry

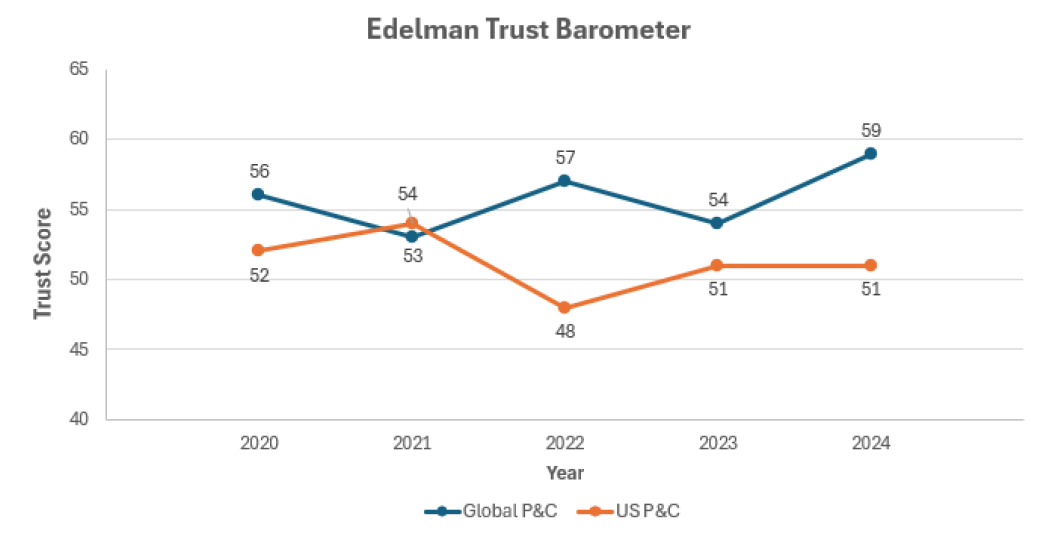

Each year, Edelman, a global communications firm that has studied the topic of consumer trust for more than 25 years, publishes an annual report of their findings across various sectors and countries. According to the 2024 Edelman Trust Barometer study, over the past five years the global property and casualty (P&C) insurance industry was given a score that fluctuated between 53 and 59. For the Edelman measure, a score of 1–49 indicates distrust, 50–59 is neutral, and 60–100 indicates a trusted industry. The global P&C insurance industry has stayed consistently in the neutral category but has improved on this measure from 2023 to 2024.

The score for U.S. companies, however, stayed flat or decreased over the same years. Although the American P&C industry lags the global P&C industry in terms of consumer trust, it still outperforms other financial services sectors in the U.S., such as financial advisory, investment management, financial technology, and cryptocurrency.

To understand the dynamics behind these scores, it is helpful to explore trust from the perspectives of both the insured and the insurer.

Trust: The insured’s perspective

Rejection rates

The claims process is typically the key moment when an insurer’s promise of financial protection is tested in practice. If policyholders are met with longer-than-expected processing times or with rejection of their claims, they may feel abandoned and frustrated, and their trust in their insurance company may erode. Mark Garrett, director at J.D. Power, says “80% of insurance customers who have poor claims experiences have already left or say they plan to leave that carrier.”

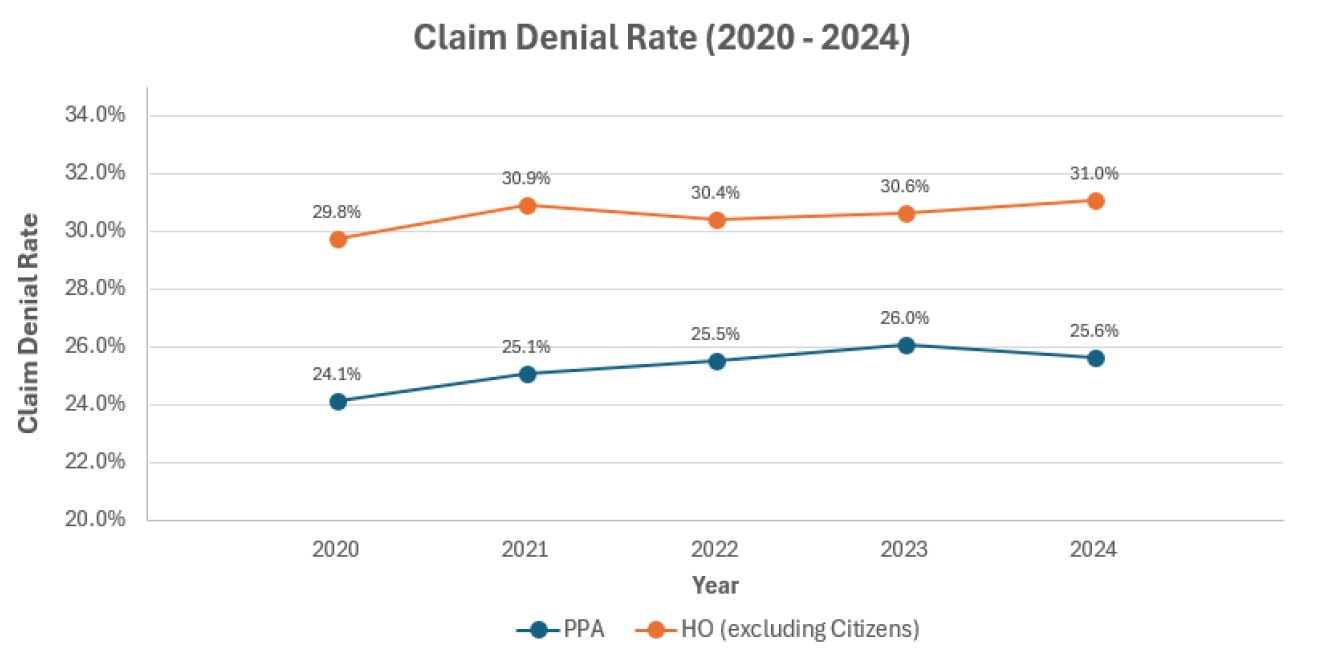

Claim denial rates, as measured by claims closed without payment as a percentage of total claims closed, have seen a slight increase in both the private passenger auto and homeowners’ lines over the last five years. Data from the NAIC’s Market Conduct Annual Statement (MCAS) Scorecard offers a view into the claim denial rate. The authors’ inferences from the scorecard show that the estimated claim denial rate in the U.S. increased from 24.1% in 2020 to 25.6% in 2024 for private passenger auto (PPA) and from 29.8% to 31.0% for homeowners’ (HO), excluding Citizens Property Insurance Corporation.

What may not be clear to the claimants, though, is that the likely cause of the increase in claim denials extends far beyond the individual claim level. In this time period of the last five years, the insurance industry saw a general increase in the cost of claims, driven by an increase in frequency and severity of natural disasters and inflation, according to Risk & Insurance. This has prompted insurers to respond by raising deductibles and imposing more coverage restrictions and higher scrutiny of complex claims.

Policy language

The other point of contact and opportunity to build trust between the insured and insurer is during the binding of the insurance policy. However, important policy details, such as price adjustments, limitations, and exclusions, can sometimes be lost in the legal jargon and fine print, leaving customers unaware of exactly what coverage they are purchasing. According to a 2024 survey by Trusted Choice, the national consumer brand representing the members of the Independent Insurance Agents & Brokers of America (the Big “I”), while 86% of respondents said they had a strong understanding of what their policies covered, the survey revealed that many were incorrect or unsure about coverages’ specifics. Some findings from the survey include:

- Flood Damage: 56% of Americans are unaware that a standard homeowner’s policy does not cover flood damage.

- Business Use of Vehicle: 55% are unaware that a standard auto policy does not cover business use of the vehicle.

- Items Stolen from Vehicle: 44% incorrectly believe that personal items stolen from their car are covered by a standard auto insurance policy, though it is in fact a standard home or renters insurance policy that typically covers such theft.

When policy terms and conditions are not clear, it can undermine trust in the insurer and leave the policyholder confused and feeling unable to make informed decisions about their coverage.

Delay, deny, defend

One of the most damaging developments of trust in insurance was the spate of lawsuits in the 1990s. Several insurers hired McKinsey & Company (McKinsey) to help with their business practices. Claims handling practices like the ones McKinsey allegedly advised were later the subject of a 2010 book called “Delay, Deny, Defend,” by Rutgers Law Professor Jay Feinman. The book portrayed a system aimed at reducing claim payments and boosting profits through more aggressive tactics, such as slowing down claim payments, denying legitimate claims, and aggressively fighting against claimants in court. McKinsey’s advice was ultimately mentioned in several bad-faith lawsuits and public backlash, contributing in part to the erosion of public trust in insurers. Allstate released internal materials referred to as the McKinsey Documents in 2008 to clarify what it described as inaccuracies in the public portrayals, claiming snippets from documents were taken out of context and that it was in good standing with respect to state market conduct regulation. However, the public perception of profit-first claims handling practices lingers to this day.

Whether it’s news stories of lawsuits, firsthand frustrations with denied claims, or opaque policy language, these experiences can potentially perpetuate a public distrust of insurance companies.

Trust: The insurer’s perspective

Trust is not a one-sided relationship. Insureds also contribute to trust challenges, whether it be intentionally through fraudulent claims or misrepresentations on applications, or through much harder-to-detect issues, such as moral hazard.

Fraud

While most Americans view insurance fraud as a crime, Verisk’s 2023 survey of 1,500 adults who were responsible for purchasing insurance for themselves or their households revealed that a non-negligible minority felt differently. Sixteen percent of respondents did not consider insurance fraud wrong. The leading response at nearly 9% justified fraud by saying “insurance companies rip people off.” Another 3% said, “I pay them enough, it is my money I am getting back.” A further 3.7% expressed the uncompromising belief that stealing insurance money is never wrong. These findings highlight that a sizable portion of insureds rationalize or tolerate fraudulent behavior and reveal underlying attitudes that insurers must navigate.

While individual survey responses provide insight into attitudes toward fraud, the actual number of fraudulent acts highlight the broader scale and persistence of the problem across the insurance industry. Looking at the numbers on a broader scale, a meta-study conducted by the Coalition Against Insurance Fraud (CAIF) indicated that insurance fraud can cost U.S. consumers more than $300 billion yearly. The three largest prone to fraud are life insurance ($74.7 billion), Medicare and Medicaid ($68.7 billion), and P&C ($45 billion). With 340 million people in the U.S., this amounts to slightly over $900 per person.

Application misrepresentations

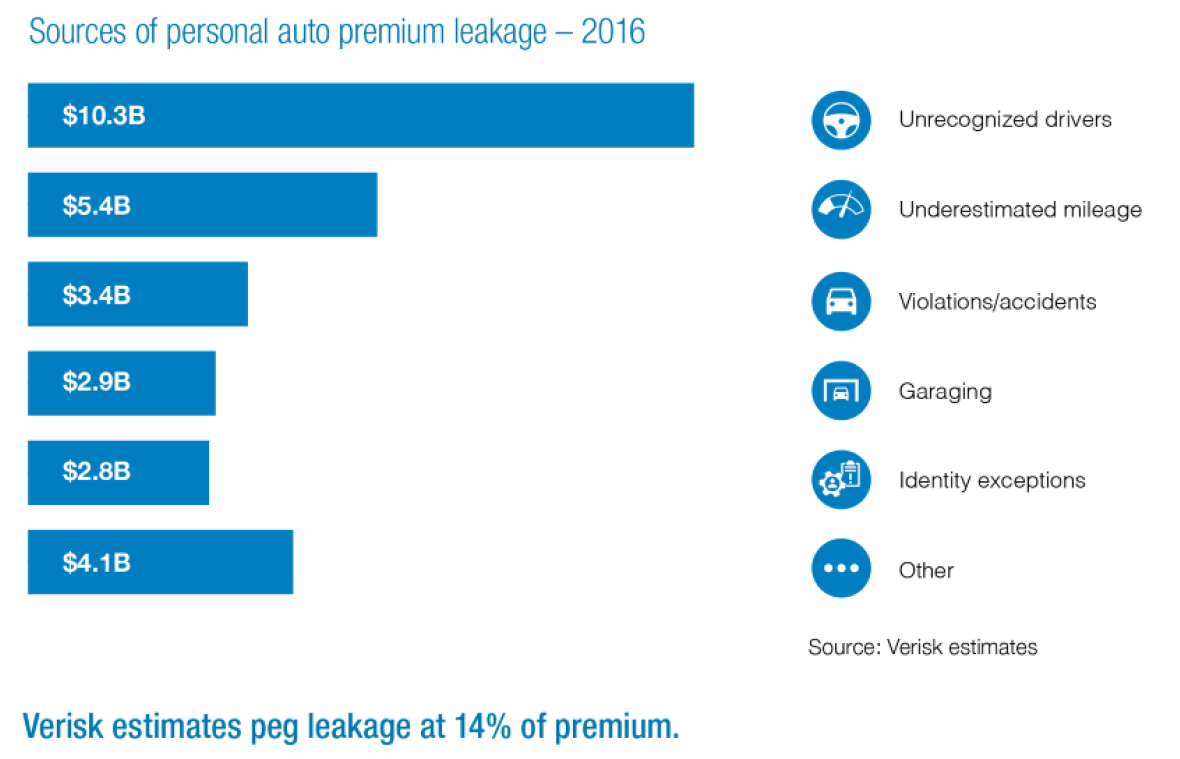

Another form of insurance fraud involves application misrepresentations, in which an applicant misleads, fails to disclose, or misstates information used for pricing in hopes of securing a better rate. Verisk’s 2017 Innovation Paper “Auto insurance premium leakage: A $29B problem for the industry” estimated that U.S. personal auto insurers lose approximately $29 billion annually in “premium leakage” arising from missing or inaccurate underwriting data, such as unrecognized drivers or misstated mileage. The study identified unrecognized drivers as the largest contributor to this leakage ($10 billion per year), underreported mileage as the next largest contributor at roughly $5 billion each year, followed by misreporting of violations and accidents accounting for approximately $3 billion annually. By analyzing these sources of misrepresentation and extrapolating across the industry, Verisk concluded that such forms of fraud represent a significant financial drain on insurers.

When fraud or application misrepresentations occur, it not only affects the parties directly involved but also has an impact on rates across the industry. Since insurers use risk pooling to spread their risk, the implications can be massive and far reaching.

Moral hazard

Moral hazard is when an insured takes less care to prevent losses because they know insurance will cover them. For example, a company may reduce the frequency of its safety inspections after purchasing liability coverage, not out of negligence but due to a shift in perceived urgency or a budget adjustment. While such behavior may seem harmless in the short term, consequences will eventually surface that may lead to larger issues not covered under the agreed upon insurance terms. Yet, as human beings, we often prioritize immediate convenience over long-term well-being, even at our own expense.

When activities of fraud, misrepresentation, and moral hazard occur, those risks have profound effects on the trust between an insurer and an insured. Both must work together and hold each other accountable. By understanding and doing what is in the other’s best interests, they are also doing what is in their own best interest.

Strengthening trust

With a clearer view of the potential sources of mistrust, we now focus on ways to restore confidence between insurers and insureds. For the insured, it is a straightforward task: be honest. If the insured is honest, the insurer can properly classify risk and price products accordingly. The insurer, conversely, can build trust in a multitude of ways, including, but not limited to, increasing transparency and leveraging technology.

Transparency

Transparency is the key to building stronger relationships in many facets of our daily lives, including work, politics, relationships, and the business of insurance. What are some ways that insurers can build trust?

Terms and conditions

One of the most effective ways an insurer can increase transparency is to make policy terms and conditions concise and digestible. Using plain language and limiting legal jargon makes it easier for consumers to understand what they are signing and can offer companies a competitive advantage.

Lemonade’s open-source policy is an example. From the market introduction of the policy, Lemonade has offered a “Squeezed Version” that is reader-friendly and provides only the necessary details to the policyholder — the policy number, the premium, and who and what is covered. The full policy terms and conditions are not hidden, however, and are still covered following the “Squeezed Version.”

As noted in the aforementioned J.D. Power auto insurance study, “ensuring customers completely understand the policy and what it covers” is one of the top four key performance indicators (KPIs) that impacts the level of trust a policyholder has in their insurer. Legal jargon is necessary for many reasons, but a concise summary with key points, paired with a competent agent or broker to help navigate nuances that may be needed on an individual basis, can help put customers at ease.

Premium breakdown

In addition to providing more concise terms and conditions, insurers can help build trust by breaking down premiums and demonstrating and justifying their pricing as reasonably as possible. The ability to show the policyholder why rates rise and fall can be a huge factor in consumer retention. When an insurer raises rates at renewal time without clear communication on the drivers of the increase, the insured may conclude that the insurance company is trying to artificially increase its profit, which could negatively impact customer satisfaction.

Alternatively, the insurance company could instead list the factors contributing to the increase, such as inflation or changes in the insured’s exposures. That may decrease the chance the customer feels that they are being dismissed or “left in the dark,” and the customer will likely appreciate the communication, even if they’re unhappy with the rate increase. Transparency in this regard can be very beneficial to the trust relationship.

Leveraging technology

Customer acquisition can be difficult in the insurance industry, but attaining a customer is only half of the battle for insurers; retaining them at policy renewal is the other half. Technology can be leveraged to aid in building trust and increase the policyholder retention rate.

Apps

In a continually evolving technological landscape, mobile app usage for business is growing. J.D. Power’s 2024 U.S. Insurance Digital Experience Study shows 74% of insurance customers have their carrier’s app installed, and 69% use it monthly and report higher customer satisfaction rates than those who don’t. By creating user-friendly portals and mobile apps, consumers can access their policy details, review coverage, track claims, and ask questions at their convenience. This empowers consumers to make informed decisions and feel more in control of the premiums they pay by building transparency and trust.

Blockchain

Implementing blockchain technology to create tamper-proof records for claims and policy transactions is another way to ensure the integrity of claims and provide customers with confidence that their claims are being handled fairly and securely. This can be done through smart contracts, digitally encoded agreements residing on a blockchain that enforces itself automatically. The blockchain carries out and records actions based on established rules without requiring third-party involvement.

However, the path to implementing blockchain has seen obstacles. In 2016, the Blockchain Insurance Industry Initiative (B3i) was formed to explore the use of blockchain in the insurance industry and was backed by leading insurers and reinsurers. Despite early success, it ultimately failed after struggling to secure new capital and maintain industry support.

Additionally, blockchain’s most famous application — cryptocurrency — remains nebulous in consumer adoption and application to the insurance industry. According to the Edelman Trust Barometer, cryptocurrency’s global trust score has been between 33 and 38 in the last four years, firmly in the “Distrust” category and lowest among the financial services sector. With these challenges in mind, it is even more paramount for insurers considering blockchain technology to be transparent and clearly communicate its use to consumers.

Telematics

Telematics is the use of technology to collect, transmit, and analyze data from vehicles and devices to monitor behaviors. It allows insurers to price based on real behavior rather than relying on broad generalizations across large groups of consumers.

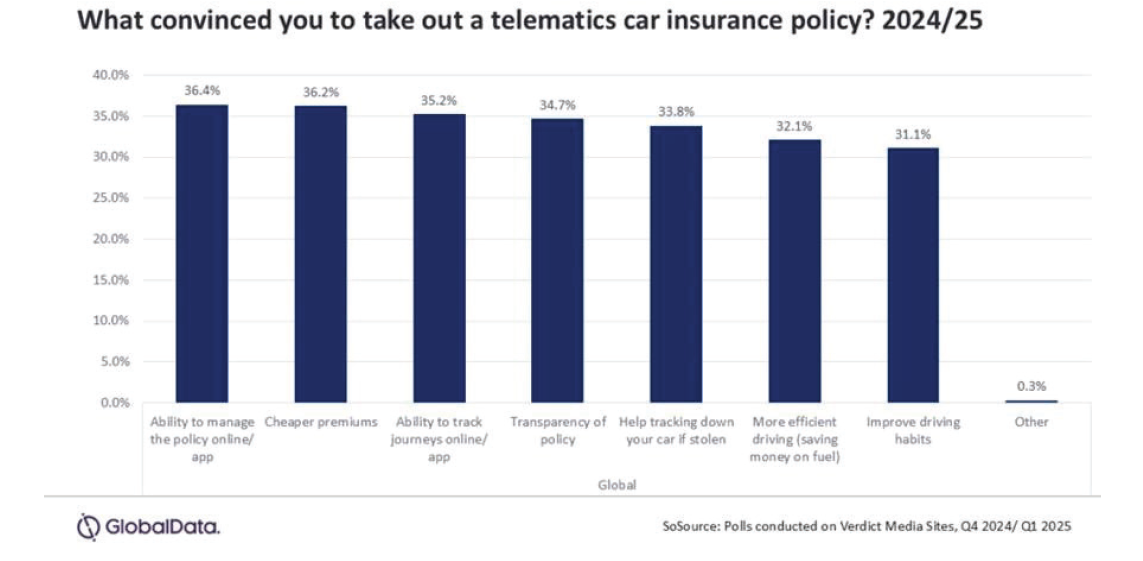

That approach helps address a common frustration among policyholders who feel they are being charged unfairly despite driving less often or more safely than others. Fortunately, many automobile insurers already offer telematics programs that provide a more personalized and transparent pricing model, helping to correct these perceived imbalances. The chart above from Insurance Business outlines some key reasons why people may opt for car insurance policies with telematics.

For the insurer, telematics aid in determining fault in an accident, understanding how an accident occurred, or reducing the time and cost to resolve disputes. It also reduces the uncertainty involved in classifying customers as low- or high-risk in terms of pricing. Furthermore, transparency (and therefore, trust) may be improved through telematics. With telematics, a customer can see a direct connection between driving behavior and premiums. That may empower drivers to adopt behaviors that can have a tangible impact on future premiums and help decrease the risk of moral hazard.

Telematics usage has been slow to be adopted, however. Despite the upsides telematics offers consumers, Actuarial Review’s Bumps in the Telematics Road: Privacy and Transparency states one of the reasons for the slow adoption is that most insurers only offer telematics-based pricing to new business customers. Another barrier to adoption is the concern around the “sheer amount of information collected by companies and the lack of transparency.”

Artificial intelligence (AI)

AI is rapidly transforming many industries, including insurance. When implemented thoughtfully, AI can offer significant advantages. It can streamline a wide range of processes. AI-powered chatbots help customers access services quickly, efficiently, and more accurately, which reduces the need for manual intervention.

In one instance, a user who submitted a claim for $979 on Lemonade’s mobile app had their claim reviewed, verified against their policy, checked for fraud, approved, and paid via wire transfer in just three seconds. While this is an exceptional instance, it illustrates the broader trend toward automated claims processing. More generally, AI paired with telematics can enable faster and more accurate assessments. And in fraud detection, AI excels at recognizing patterns across vast datasets that would be impossible for human investigators to detect in a timely fashion.

It’s important to remember, however, that AI also has the potential to erode trust. Automated systems can sometimes overlook human nuance. They may lack empathy in decision-making. These are two key building blocks of trust. There is also the risk of biases embedded in AI’s data or design that can lead to unfair outcomes for certain groups. The insurance industry is focused on research, and studies are underway with regard to AI regulation in insurance that will help understand and lessen such risks.

Ultimately, no matter the technology or tool being implemented, trust can only be built when it is used responsibly and the customer’s needs and experiences are at the forefront.

Summary

The insurance industry is built on a foundation of trust and a mutual pledge: the insurer provides financial protection, and the insured provides transparency and payment. We have seen, however, that this trust is often put under duress from both sides. From the insured’s perspective, trust in insurance companies can be marred by claim rejections, unclear policy language, and high-profile lawsuits. At the same time, insurers face issues such as fraud, misrepresentation, and moral hazard.

However, stronger communication and transparency can help restore confidence. Through thoughtful policy design and deployment of technology such as mobile apps, telematics, blockchain, and artificial intelligence, the insurance industry has reached an important moment, one with real opportunities to build trust and create a satisfactory experience for everyone involved.

Kobe Balson is an actuarial analyst at Pinnacle Actuarial Resources based in Chicago. Travis Peralta is an actuarial analyst at Pinnacle Actuarial Resources based in Chicago. Honggeol Jun is a student at the University of Texas – Austin, majoring in mathematics, actuarial sciences. The three authors presented this topic at the 2025 Pinnacle University, an event showcasing emerging topics in the insurance industry and actuarial profession. This article has been peer reviewed by Sara Chen, FCAS, MAAA, consulting actuary at Pinnacle Actuarial Resources.

Sources

https://www.jdpower.com/business/press-releases/2024-us-auto-insurance-study

https://www.jdpower.com/business/press-releases/2024-us-auto-claims-satisfaction-study

https://content.naic.org/mcas_data_dashboard.htm

https://en.wikipedia.org/wiki/Delay,_Deny,_Defend

https://www.verisk.com/blog/auto-insurance-premium-leakage-a-29b-problem-for-the-industry/.

https://www.lemonade.com/policy-two

https://www.jdpower.com/business/insurance/auto-insurance-study

https://www.jdpower.com/business/press-releases/2024-us-insurance-digital-experience-study

https://www.ledgerinsights.com/major-insurers-pull-the-plug-on-b3i-insurance-blockchain-consortium/

https://ar.casact.org/bumps-in-the-telematics-road-privacy-and-transparency/

https://www.lemonade.com/blog/lemonade-sets-new-world-record/

https://ar.casact.org/ai-regulation-in-insurance-a-road-to-unintended-consequences/