Many people view insurance as stodgy and boring, lacking the excitement and innovation of Silicon Valley technology industries. But the reality is that we have significant innovations happening — often behind the scenes and invisible to our policyholders — that ought to be celebrated and shared more broadly. “Parametric Insurance: From Need to Solution,” a session at the virtual 2022 CAS Ratemaking, Product and Modeling Seminar, attempted to share one such story of insurance innovation.

The parametric insurance session covered the breadth of the topic, from defining the comparatively new product solution through the product development and design processes. Jonathan Charak, FCAS, of Zurich North America presented an overview of parametric insurance and the product development cycle. Daniel Seyyedi of Swiss Re took a deeper dive into the product design for parametric insurance solutions.

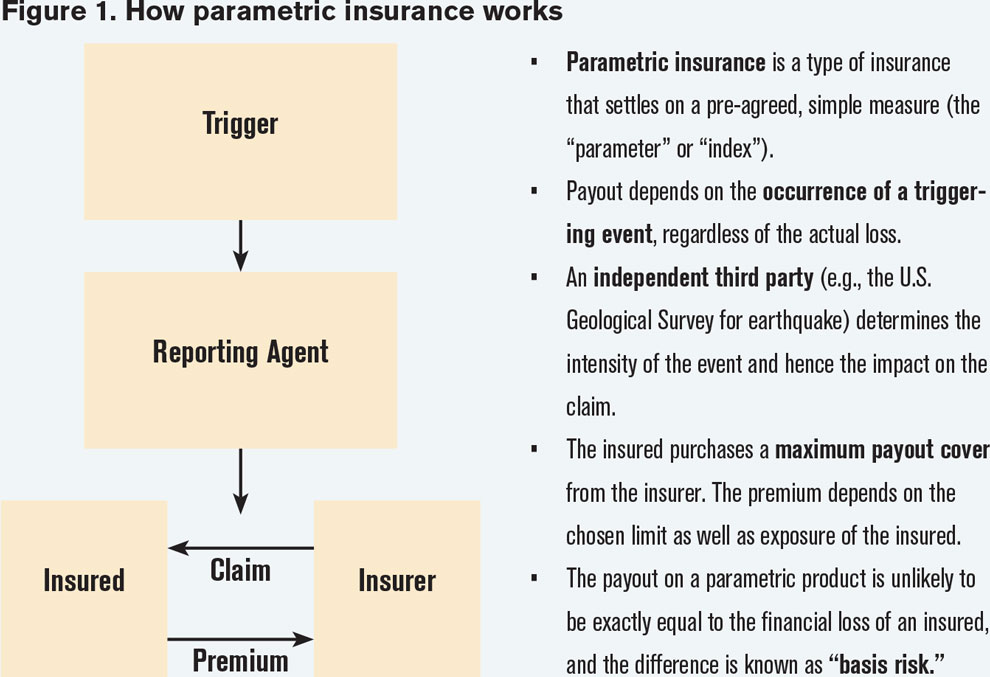

Parametric insurance is a variation on the traditional insurance contract with a couple of key twists. First, the contract settles on a pre-agreed, simple measure (commonly referred to as the parameter or index), which is fully transparent and indisputable by any party involved. Second, it pays out a pre-defined amount when the triggering event occurs, which simplifies estimating the severity of loss. Figure 1 captures how parametric insurance works and the key participants to the contract.

Charak’s presentation walked through the product development life cycle as his company applied it to parametric insurance. The company starts from the reality that insurers need to develop insurance products that their distribution partners can sell and customers will buy as part of their complete risk management strategy. The process needs to be customer-led to ensure that the company is solving for a customer’s needs, and the process needs to include a multidisciplinary team to ensure development of holistic product solutions.

Parametric insurance was initially designed to narrow the protection gap. Charak defined this for natural catastrophes to be society’s total economic loss minus the industry’s insured loss. This gap commonly occurs because of the affordability and availability of insurance products that consumers will purchase. Over the last three decades, this gap has been significant for U.S. natural catastrophes, including non-damage business interruption (NDBI).

Similar insurance protection gaps can exist outside catastrophes, so companies can use parametric insurance for “exotic” risks like reduced foot traffic and cyber-related risks across these offerings. The common denominator is a verifiable and objective trigger that both the insurer and the insured agree upon to measure an event.

The platform is comprehensive and yet flexible enough to be used globally for a wide range of parametric products with expedited timelines.

Zurich North America announced its first parametric insurance proposition to the market in January 2021 to cover weather-related construction delays. They followed the product development cycle, evaluating modeling ability, the market opportunity, the insurer’s risk appetite and the distribution model. Through experimentation, they launched an offering to help close the insurance gap; this helps the economic recovery of an impacted community after a catastrophic event.

Seyyedi then shared his presentation about Swiss Re’s product design of parametric insurance solutions. Swiss Re asked what parametric insurance is best used for:

- As emergency cash relief that pays out immediately (no waiting for claim adjusting process).

- When traditional insurance is not accessible or affordable.

- As a complement to traditional insurance.

In short, parametric insurance is fast, flexible and transparent, though with some offseting challenges.

One key challenge is the introduction of basis risk, defined as the deviation of the insurance payout from the actual financial loss. Swiss Re has developed a multi-trigger parametric insurance product to mitigate the insured’s basis risk. The company introduces a second trigger evaluation date for the insured to provide proof of loss beyond the insured’s initial recovery.

Seyyedi shared two product design examples — one each for hurricane and earthquake. For both, the key components are:

- Triggers (e.g., certain windspeed measures or magnitude).

- Shape and size of box (defines the geographic boundary covered by the contract).

- Reporting agencies (e.g., National Hurricane Center, U.S. Geological Survey).

Swiss Re has a modular parametric IT platform that is streamlined to provide end-to-end solutions, including product design, quoting and pricing, and policy and claim administration. The platform is both comprehensive and flexible enough to be used globally for a wide range of parametric products with expedited timelines.

This session was highly informative for people who have never worked with parametric insurance in their career. Charak and Seyyedi provided an excellent overview of the product and the many ways it can be used by insurers and reinsurers. They each went deeper to share applications from their respective companies — going from theory to practice in a single session.

Dale Porfilio, FCAS, MAAA, is chief insurance officer for the Insurance Information Institute.